Bitcoin Crash: Why BTC Dropped Below $90K

Bitcoin's Sharp Decline: What Triggered the Crash?

Bitcoin plunged below $90,000 on November 17, 2025, hitting a low of $89,420 – its weakest point since February. This dramatic reversal comes just six weeks after the cryptocurrency reached a record high of $126,250, erasing all 2025 gains and triggering widespread panic in crypto markets. But what exactly caused this sudden crash?

The technical catalyst was a "death cross", a bearish signal that occurs when the 50-day moving average crosses below the 200-day moving average. This indicator, triggered after Bitcoin failed to reclaim key support at $93,700, has historically coincided with multi-week drawdowns when combined with evaporating liquidity and stalled institutional inflows.

Key Factors Behind the Bloodbath

"The slide accelerated after Bitcoin failed to reclaim key support at $93,700 over the weekend, breaking below its 200-day moving average and triggering a 'death cross' between the 50-day and 200-day trendlines."

Several interconnected factors fueled the downward spiral:

- Stalled ETF Inflows: U.S. spot Bitcoin ETFs, which absorbed over $25 billion earlier in 2025, have seen flatlined inflows for nearly two weeks. This shift comes amid concerns that President Trump's tariff agenda could reignite inflation and delay Federal Reserve rate cuts.

- Institutional Pause: Corporate balance-sheet buyers who aggressively accumulated Bitcoin in the first half of 2025 have temporarily halted purchases, removing a key source of demand.

- Macro Headwinds: Persistent inflation fears and uncertainty about future monetary policy have made risk assets like Bitcoin less attractive to traditional investors.

Market Sentiment Hits Panic Mode

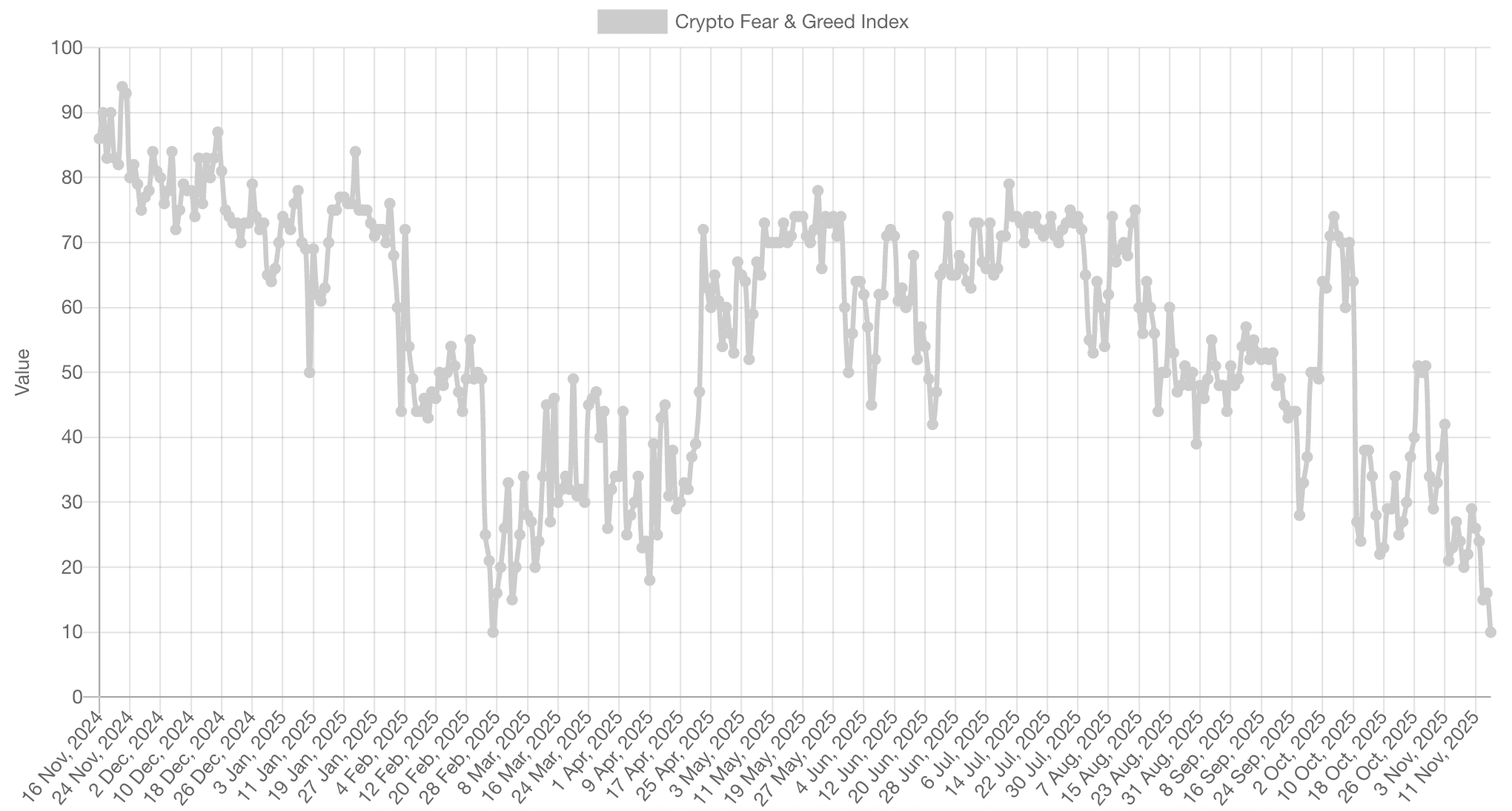

Retail stress has reached extreme levels. The Crypto Fear & Greed Index plummeted to 11, its lowest reading since the 2022 bear market, signaling "extreme fear" among investors. Meanwhile, Bitcoin's social dominance – the share of market conversation focused on BTC – has spiked to near-historical highs, indicating traders are abandoning altcoins to focus solely on the benchmark asset.

What's Next for Bitcoin?

Analysts warn that failure to reclaim $93,000 soon could expose Bitcoin to further downside, with a "clear liquidity pocket" emerging between $86,000-$88,000. However, some experts see potential for short-term relief rallies if ETF flows stabilize and macro data shows signs of cooling.

Long-term bulls remain optimistic. Dan Tapiero, founder of 50T Holdings, views the current volatility as "just noise" driven by short-term uncertainty. He points to Bitcoin's strong fundamentals and growing institutional interest as reasons to remain confident in the asset's long-term prospects.

As the dust settles, one thing is clear: Bitcoin's latest crash has exposed the fragility of its recent rally and the powerful influence of technical indicators and macroeconomic forces on crypto markets.

Share this article

Dr. David Chen

Science correspondent with a Ph.D. in astrophysics, passionate about making complex scientific discoveries accessible to all.