Cortez Masto Fights to End Coffee Tariffs

As the price of your morning cup of coffee continues to climb, Senator Catherine Cortez Masto (D-Nev.) is taking action to address the soaring costs directly tied to new import tariffs. The senator has introduced the bipartisan "No Coffee Tax Act," a bill aimed at exempting coffee from President Trump's "reciprocal tariffs" that are significantly impacting American consumers and businesses.

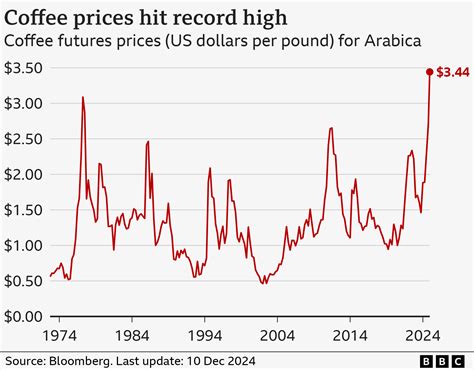

The legislation, co-authored with Senator Rand Paul (R-Ky.), comes at a critical time when coffee prices are reaching unprecedented heights. According to recent data, the average grocery store price for a pound of roasted, ground coffee reached $9.14 in September, a staggering 41% increase from the previous year. The broader coffee index tracked by the Bureau of Labor Statistics shows an even more dramatic 18.9% year-over-year increase, far outpacing overall food and beverage inflation.

The Tariff Impact on American Coffee

The tariffs affecting coffee imports range from 10% to 50%, depending on the country of origin. Notably, Brazilian coffee faces a particularly steep 50% tariff, which has an outsized impact on the U.S. coffee market given Brazil's status as the world's largest coffee producer.

"I know that responsible, targeted tariffs on our adversaries can be good for American workers and our national security," Cortez Masto explained during her remarks on the Senate floor. "There's a smart way to do this, but taxing our coffee and raising prices for Americans isn't it."

A Bipartisan Effort Faces Obstruction

Despite its bipartisan nature, the bill's path forward has encountered resistance. In a recent attempt to fast-track the legislation through the Senate using unanimous consent—a procedure typically reserved for noncontroversial bills—Senator Mike Crapo (R-Idaho), the Republican chair of the Senate Finance Committee, objected to the move.

This procedural objection sends the bill back to committee level, where it will await further consideration. Crapo's reasoning for blocking the fast-track centered on his opposition to "one-off exceptions" for certain imported goods "in isolation of a larger negotiating strategy and broader stakeholder concerns."

The Economic Reality of Coffee Production

The economic rationale behind the No Coffee Tax Act stems from a simple reality: the United States cannot produce coffee at a scale anywhere near necessary to meet domestic demand. Coffee production in Hawaii and Puerto Rico combined represents less than one percent of U.S. green coffee demand, making the country heavily dependent on imports.

"Coffee isn't just a beverage; it's an integral part of daily life for millions of Americans," Cortez Masto emphasized. "For small businesses like local coffee shops and for families tightening their budgets, these tariffs are creating an unnecessary burden."

Industry Response and Future Outlook

The coffee industry has expressed strong support for the legislation, with industry groups warning that continued tariffs could lead to further price increases, reduced consumption, and potential job losses across the coffee supply chain, from importers to local baristas.

As the bill returns to committee, the debate highlights the tension between protectionist trade policies and their immediate impact on consumer goods. The No Coffee Tax Act represents a specific countermeasure to address what many see as an unintended consequence of broader trade strategy.

For now, coffee lovers and industry stakeholders will be watching closely to see if the bill gains traction in committee or if it becomes another casualty of the increasingly complex trade landscape.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.