Ethereum (ETH) Price Crashes 40%: What's Driving the Crypto Slide?

Ethereum's Historic Decline: A Market in Turmoil

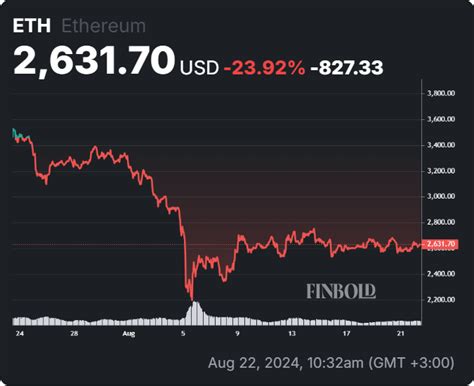

Ethereum (ETH) is currently facing its most significant price plunge since May 2025, with the digital asset tumbling 40% from its all-time high of $4,946.05 reached on August 24. As of recent reports, ETH is struggling to maintain the $3,000 psychological level, marking a dramatic reversal from its near-$5,000 peak just months ago. This sharp decline mirrors broader market instability, coinciding with a 25% selloff in Bitcoin and accelerating volatility across the cryptocurrency sector.

Key Factors Fueling Ethereum's Price Drop

Several critical factors are converging to create this perfect storm for Ethereum:

- ETF Outflows: Ethereum-focused exchange-traded funds saw massive redemptions on November 13, with $259.72 million withdrawn—the highest daily outflow in over a month. This exodus of retail capital signals growing investor skepticism toward ETH's short-term prospects.

- Market Risk Aversion: Heightened concerns about overvaluation and economic uncertainty have triggered widespread risk-off sentiment. The ongoing U.S. government shutdown and lack of economic data from Washington D.C. have amplified market anxiety.

- Broader Crypto Weakness: ETH's decline isn't occurring in isolation. The entire cryptocurrency market is under pressure, with major coins experiencing synchronized losses that reinforce negative sentiment.

Technical Analysis: Critical Levels Ahead

From a technical standpoint, Ethereum's 40% drop has erased significant gains accumulated earlier in 2025. The asset is now testing support levels last seen during the May selloff triggered by President Trump's tariff regime. Year-to-date, ETH remains down 5%, but the recent acceleration raises questions about whether further downside is imminent. Traders are closely monitoring the $3,000 threshold, as sustained breaks below could trigger additional liquidation.

A chart visualizing Ethereum's 40% price decline from its August 2025 peak.

What This Means for Investors

While most analysts avoid direct ETH ratings or price targets, the market dynamics paint a clear picture of heightened volatility. The combination of ETF outflows, macroeconomic uncertainty, and broader crypto market weakness suggests that Ethereum may face continued pressure in the near term. However, some long-term proponents view this as a healthy correction after the unprecedented rally earlier in 2025.

Looking Ahead: Catalysts to Watch

Several developments could influence Ethereum's trajectory:

- Government Shutdown Resolution: Progress in Washington D.C. could restore market confidence and risk appetite.

- Institutional Adoption Signals: Any positive news regarding institutional crypto adoption or regulatory clarity could reverse the current downtrend.

- ETF Flow Reversals: A return of capital to Ethereum ETFs would indicate renewed investor interest.

Investor monitoring Ethereum price fluctuations during the market downturn.

Conclusion: Navigating Volatility

Ethereum's 40% plunge serves as a stark reminder of cryptocurrency markets' inherent volatility. While the fundamentals of blockchain technology remain intact, short-term price movements are increasingly influenced by macroeconomic factors and investor sentiment. As the market digests these developments, ETH holders should prepare for continued turbulence and consider their risk tolerance carefully. The coming weeks will be critical in determining whether this is a temporary correction or the beginning of a more prolonged bear phase for the world's second-largest cryptocurrency.

Share this article

Dr. David Chen

Science correspondent with a Ph.D. in astrophysics, passionate about making complex scientific discoveries accessible to all.