S&P 500: A Decline Ahead? Look to 2021, Not Dot-Com

The S&P 500's Next Move: Historical Lessons for Investors

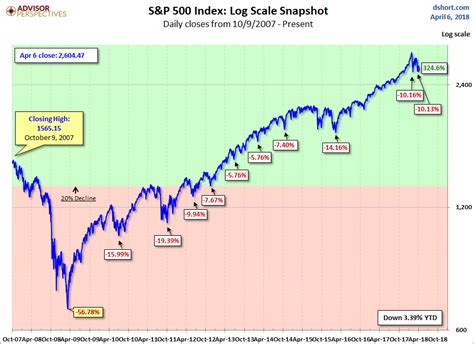

The S&P 500 stands at a critical juncture, with whispers of an impending decline growing louder. While market corrections are inevitable, history suggests the coming downturn may resemble 2021's pullback rather than the catastrophic dot-com bubble. Understanding this distinction could be the key to navigating volatility.

Why a S&P 500 Decline is Inevitable

Every market cycle experiences downturns. The S&P 500, representing 500 large U.S. companies, has seen multiple corrections throughout history. Current indicators – including stretched valuations, geopolitical tensions, and economic uncertainty – suggest a near-term correction is probable. However, the magnitude and nature of this decline warrant closer examination.

2021's Blueprint: A Controlled Correction

The 2021 market correction offers a compelling parallel. Unlike the dot-com era's speculative frenzy, 2021's decline was driven by:

- Interest rate normalization

- Profit-taking after pandemic gains

- Sector rotation rather than systemic collapse

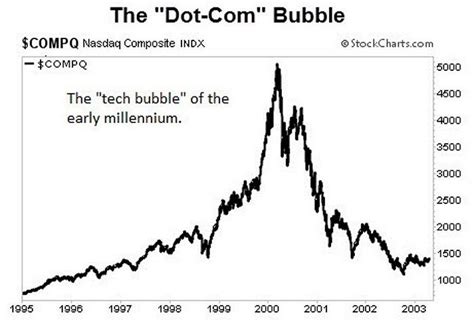

The Dot-Com Trap: A Cautionary Tale

The 2000 dot-com bubble collapse remains Wall Street's most painful memory. Fueled by irrational exuberance and overvalued tech stocks, the S&P 500 plummeted nearly 50% over two years. Key differences from today include:

Today's market shows fewer red flags of such systemic risk.

- Excessive debt-fueled speculation

- Lack of earnings backing valuations

- Broader market participation in irrational hype

Key Contrasts: 2021 vs. Dot-Com

| Factor | 2021 Correction | Dot-Com Bubble |

|---|---|---|

| Valuation Metrics | Moderately elevated | Extreme (P/E > 40) |

| Economic Backdrop | Recovery underway | Post-bubble recession |

| Duration | Months | Years |

| Cause |

What This Means for Investors

History suggests the coming S&P 500 decline will be a buying opportunity rather than a catastrophe. Key strategies include:

- Rebalancing portfolios toward quality stocks

- Adding defensive sectors (utilities, healthcare)

- Using dollar-cost averaging for new investments

- Avoiding panic selling during temporary dips

The Path Forward

While no one can predict market timing with certainty, historical patterns indicate the S&P 500's next correction will be a temporary setback in a longer-term upward trajectory. Investors who focus on fundamentals rather than headlines may emerge stronger on the other side.

As always, consult with a financial advisor to align strategies with personal risk tolerance and goals.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.