AVGO Stock: The AI Powerhouse You Need

Why AVGO Stock is a Must-Have in Your Portfolio

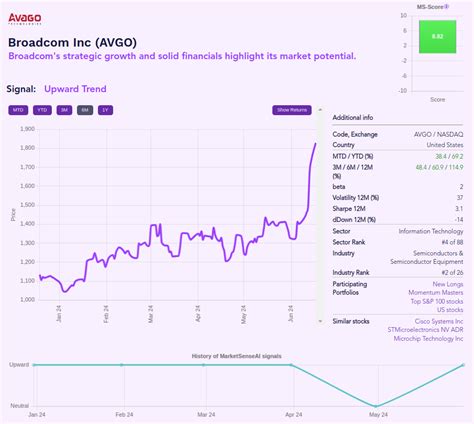

As artificial intelligence continues to reshape the global economy, investors are scrambling to find stocks positioned at the epicenter of this technological revolution. Among the top contenders is Broadcom (AVGO), a semiconductor giant making waves in the AI infrastructure space. With its strategic acquisitions and focus on high-growth markets, AVGO stock is emerging as a compelling long-term investment.

Broadcom's AI Ambitions

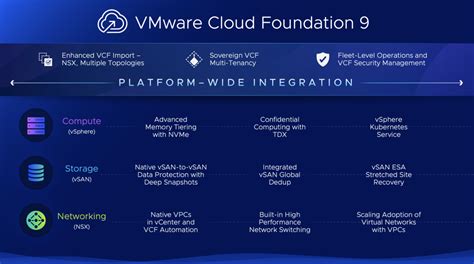

Broadcom isn't just another chipmaker—it's a dominant force in critical AI infrastructure components. While competitors like Nvidia capture headlines with their GPUs, Broadcom is quietly powering the data center revolution through its specialized networking and connectivity solutions. Its VMWare acquisition provides essential software for virtualizing AI workloads, while its custom ASIC chips optimize data center efficiency.

"Broadcom is increasingly seen as a formidable competitor to Nvidia in the AI chip ecosystem, leveraging its expertise in high-performance networking and software integration."

Market Dominance and Growth Catalysts

With a market cap exceeding $700 billion, Broadcom's influence spans multiple high-growth sectors:

- AI Infrastructure: Providing essential networking and connectivity solutions for data centers handling AI workloads.

- 5G/6G Technology: Dominating the wireless semiconductor market as carriers upgrade networks.

- Enterprise Software: Leveraging the VMWare acquisition to capture the burgeoning edge computing market.

Financially, Broadcom has delivered exceptional results. The company reported a 34% year-over-year revenue increase in its latest quarter, driven by strong AI demand. Its gross margins of 76% reflect premium pricing power in its specialized segments.

The Competitive Landscape

While Nvidia currently leads the GPU market, Broadcom is carving out a critical niche in complementary technologies:

- Networking switches that connect thousands of AI servers >Optical components enabling high-speed data transfer >Custom ASICs for specific AI workloads

As noted in market analyses, "Broadcom's strategic partnerships with hyperscale cloud providers position it uniquely to benefit from the $280 billion data center infrastructure build-out expected by 2030."

Risks and Considerations

No investment is without risks:

- Cyclicality: Semiconductor demand can fluctuate with economic cycles

- Regulatory Scrutiny: Potential antitrust concerns surrounding the VMWare integration

- Competition: Intensifying rivalry from Intel and AMD in networking segments

The Long-Term Outlook

Analysts project AVGO stock could double by 2030, driven by:

- Expanding addressable market in AI infrastructure to $140 billion

- Sustained 15-20% annual revenue growth in its software segment

- Consistent dividend growth (current yield ~1.5%)

For investors seeking exposure to AI beyond pure-play GPU manufacturers, Broadcom offers a diversified entry point into the broader AI ecosystem. Its combination of hardware expertise and software integration creates a defensible competitive advantage in the race to power artificial intelligence.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.