Bitcoin Crash: Why BTC Is Falling to 6-Month Low

Bitcoin Price Plummets to Lowest Level Since April

Bitcoin (BTC) has experienced a significant downturn, falling to its lowest level in over six months as investors retreat from riskier assets amid uncertainty about Federal Reserve policy. The flagship cryptocurrency dropped to as low as $86,325.81 on Thursday, marking its lowest point since April 21, 2025, according to market data.

The digital currency last traded at approximately $86,690.11, reflecting a substantial decline from recent highs. This price movement comes as part of a broader retreat from risky investments, with the entire cryptocurrency market experiencing downward pressure.

Strong Jobs Data Fuels Rate Cut Uncertainty

The recent release of stronger-than-expected U.S. jobs data has created uncertainty about the Federal Reserve's monetary policy. The U.S. economy added 119,000 jobs in September, significantly exceeding the 50,000 jobs that economists had forecasted.

This robust employment report has sent ripples through financial markets, with the probability of a December rate cut now hovering around 40%, according to the CME Group's FedWatch tool. Higher interest rates generally make non-yielding assets like Bitcoin less attractive to investors.

Bitcoin's price has largely slid since a rash of cascading liquidations of highly leveraged crypto positions in early October.

Broader Crypto Market Decline

Bitcoin's struggles are not occurring in isolation. The entire cryptocurrency market is facing pressure, with other major digital currencies also experiencing significant declines. Ether (ETH) has shed more than 3% to trade well below $3,000, while XRP fell by 2.3% and is now below the $2.00 mark. Even popular meme coins like Dogecoin have been affected by the market-wide downturn.

The correlation between traditional markets and cryptocurrencies has become increasingly evident, with Bitcoin's decline contributing to broader stock market weakness. Notably, this occurred despite a blockbuster earnings report from Nvidia, which typically boosts AI-related stocks.

Worst Monthly Performance Since 2022

According to data compiled by Bloomberg, Bitcoin is now heading for its worst monthly performance since the series of corporate collapses that rocked the crypto sector in 2022. The digital currency has shed approximately a quarter of its value in November alone, the most significant single-month decline since June 2022.

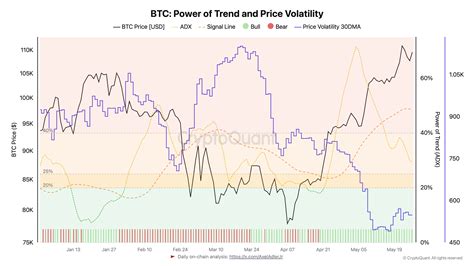

This dramatic drop has erased much of the gains Bitcoin had accumulated earlier in the year, raising questions about the sustainability of its previous price rally. The current downturn highlights the inherent volatility of cryptocurrency markets and their sensitivity to macroeconomic factors.

What's Driving the Bitcoin Sell-Off?

Several factors appear to be contributing to Bitcoin's recent price decline:

- Reduced Market Risk Appetite: Investors are becoming more risk-averse, pulling money from speculative assets like cryptocurrencies.

- Monetary Policy Uncertainty: The Federal Reserve's potential interest rate decisions are impacting investor sentiment toward non-yielding assets.

- Leverage Liquidations: As mentioned earlier, cascading liquidations of highly leveraged crypto positions since early October have accelerated the downward price movement.

- Market Correlation: The growing connection between Bitcoin and traditional markets means that broader economic factors are increasingly influencing its price.

What's Next for Bitcoin?

The coming weeks will be crucial for Bitcoin as investors await further economic data and Federal Reserve signals. Key events to watch include:

- Upcoming inflation reports

- Additional employment data

- Federal Reserve meetings and statements

- Regulatory developments in the cryptocurrency space

- Institutional adoption news

Despite the recent downturn, many long-term Bitcoin proponents remain optimistic about its future, pointing to factors like institutional adoption, scarcity, and its potential as a store of value. However, the current market conditions highlight the importance of risk management for cryptocurrency investors.

As the cryptocurrency landscape continues to evolve, investors should stay informed about both macroeconomic factors and developments specific to the digital asset space. The current Bitcoin price drop serves as a reminder of the volatile nature of these markets and the importance of a well-diversified investment strategy.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.