Bitcoin Slides Below $81K Amid Market Turmoil

Bitcoin's Recent Price Plunge: Key Factors and What's Next

Bitcoin has entered a period of significant volatility, dropping below the critical $81,000 mark as broader market pressures intensify. The cryptocurrency's sharp decline—falling as much as 6% in a single session—highlights its growing correlation with traditional risk assets and underscores shifting investor sentiment in the current economic climate.

Market Dynamics Driving the Decline

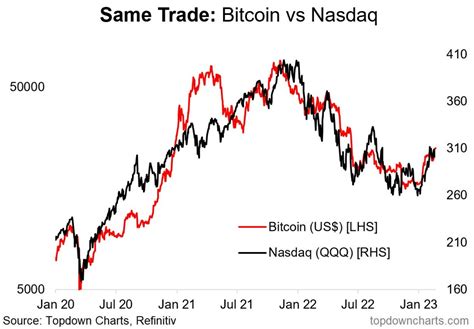

The recent downturn follows a broader sell-off in U.S. stock markets, particularly the Nasdaq Composite, which fell 2% on Thursday. Bitcoin has increasingly mirrored tech stock movements, with many AI and crypto investors holding overlapping portfolios. This correlation intensified when Nvidia's earnings rally fizzled, prompting a flight from high-risk assets.

"We're seeing a rotation out of speculative assets like crypto and AI stocks into safe havens," explains Sebastian Pedro Bea, CIO at ReserveOne. "Bitcoin's price action has been unimpressive across large tokens, with long-term holders becoming more active."

ETF Flows and Technical Support Levels

Analysts highlight dwindling ETF inflows as a major concern. Citi's Alex Saunders notes that "ETF flows, the main driver of BTC prices, are also drying up, adding to short-term performance worries." This reduction in institutional buying pressure compounds Bitcoin's technical vulnerabilities.

Technically, Bitcoin is hovering near its $80,000 support level—a critical psychological and technical threshold. TradingView charts show this level hasn't been breached since April 2025, making it a focal point for traders. A sustained break below could trigger further liquidations and accelerate losses.

Broader Market Impacts

The ripple effects extend beyond Bitcoin itself. Cryptocurrency stocks have plummeted, with:

- Strategy falling 42% monthly

- American Bitcoin shedding 7% in recent sessions

- Riot Platforms down 4% intraday

"We're in very oversold territory for Bitcoin now," adds Pedro Bea, suggesting potential relief rallies may emerge if support holds.

What Lies Ahead?

Despite the current slump, Bitcoin remains up over 260% since President Trump's inauguration and still trades above its year-start price. However, its 30% drop from October's $126,000 peak signals a significant correction.

Key watchpoints include:

-

li>ETF data reversal signs

li>Nasdaq stabilization

li>Regulatory policy developments

Traders using TradingView should monitor the $80,000 level closely, with potential resistance forming around $85,000-$88,000 if bulls regain control.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.