Decoding the FOMC Minutes: What Investors Need to Know

The Federal Open Market Committee (FOMC) minutes are among the most anticipated documents in financial markets. Released three weeks after each FOMC meeting, these detailed transcripts offer critical insights into the Federal Reserve's policy decisions and economic outlook. For investors, understanding these minutes isn't just beneficial—it's essential for navigating market volatility and making informed decisions.

What Are the FOMC Minutes?

The FOMC minutes are verbatim records of discussions, debates, and votes during the Fed's monetary policy meetings. Unlike the brief policy statements released immediately after meetings, the minutes provide granular details about:

- Members' economic forecasts

- Policy decision rationale

- Future policy trajectory discussions

- Risks to economic outlook

They offer transparency into the Fed's decision-making process, helping investors anticipate future interest rate moves, quantitative easing/tightening programs, and policy shifts.

Why Do They Move Markets?

Financial markets react sharply to FOMC minutes because they reveal:

'Hawkish' signals (potential rate hikes) often trigger sell-offs in bonds and growth stocks

'Dovish' signals (rate cuts or pause) can boost investor confidence and risk assets

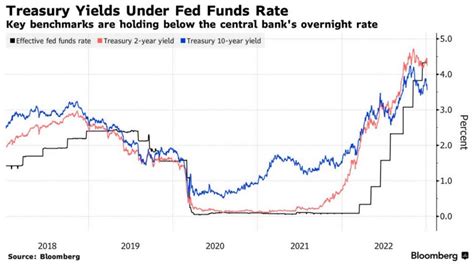

For example, minutes suggesting concerns about inflation might cause immediate Treasury yield spikes, while discussions about labor market weakness could fuel rally expectations. The market's focus is particularly intense on:

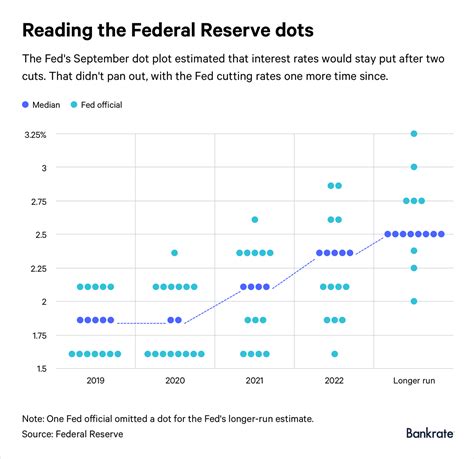

- Any shifts in the dot plot projections

- Language about 'balance of risks'

- Discussion about inflation vs. employment priorities

Key Sections to Watch

When analyzing the minutes, investors should prioritize:

- Economic Assessment: How members view inflation trends, labor market strength, and GDP growth.

- Policy Debate: Differing opinions among members about the pace of policy adjustments.

- Future Guidance: Clues about upcoming meetings and potential policy pivots.

- Risk Analysis: Explicit mentions of financial stability risks or economic uncertainties.

Recent Developments and Market Impact

Recent FOMC minutes have revealed growing concerns about persistent inflation alongside labor market resilience. This has led markets to:

- Price in fewer rate cuts than previously expected

- Reprice Treasury yields higher

- Shift focus to 'higher for longer' policy stance

The minutes also highlighted Fed officials' debates about the lagged effects of previous tightening cycles, signaling that patience may be required before pivoting.

How to Effectively Use the Minutes

To leverage FOMC minutes for investment decisions:

- Compare with prior meetings: Track evolving language and sentiment shifts.

- Cross-reference with data: Align Fed views with recent inflation, jobs, and GDP reports.

- Monitor market reactions: Observe how asset prices respond to minute releases.

- Consider consensus forecasts: Use Fed-watchers' interpretations as a baseline.

The Bottom Line

FOMC minutes are more than just historical records—they're crystal balls into Fed thinking. By decoding these documents, investors gain a competitive edge in anticipating market-moving policy shifts. As the Fed navigates an uncertain economic landscape, the minutes will remain indispensable tools for anyone serious about understanding financial markets.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.