Dow Jones Surges on Market Rally

Market Soars: Dow Jones Leads the Charge Amidst Rally

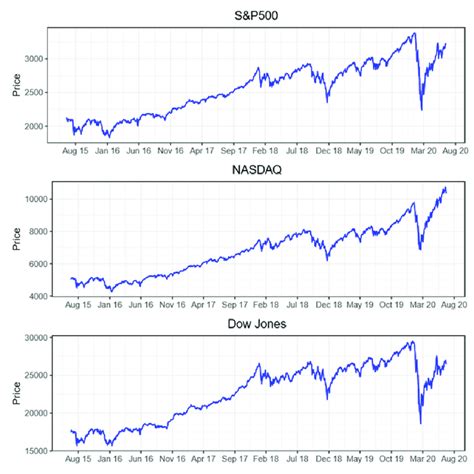

The stock market has been buzzing with excitement recently as major indices, including the Dow Jones Industrial Average, Nasdaq, and S&P 500, have all seen significant gains. This rally has sparked hopes of a strong rebound from the losses experienced in November, leaving investors optimistic about the market's direction.

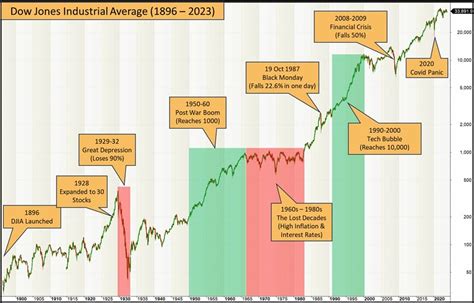

The Dow Jones Industrial Average, often referred to as simply the Dow, is one of the most closely watched stock market indices in the world. It tracks 30 large, publicly-owned companies based in the United States and is seen as a barometer of the health of the U.S. economy. The recent surge in the Dow is particularly noteworthy because it comes after a period of volatility and uncertainty.

[IMAGE_1]What's Driving the Rally?

Several factors are contributing to this market optimism. First, there's been positive news on the economic front, with better-than-expected job reports and inflation data easing. Additionally, the technology sector, which heavily influences the Nasdaq index, has shown resilience and growth. The Nasdaq today is up, driven by gains in major tech companies.

Meanwhile, the S&P 500 index, which includes 500 of the largest U.S. companies, has also been climbing. The broad-based index is considered a more comprehensive measure of the market than the Dow, and its performance is a key indicator for many investors. The S&P 500's strength in recent days has been a significant factor in the overall market sentiment.

Impact on Investors

For investors, this rally brings a sense of relief after the downturn in November. The rebound suggests that the market may have been oversold and that there is underlying strength. However, experts caution that the market could face headwinds in the form of rising interest rates and geopolitical tensions. It's important for investors to stay informed and consider their risk tolerance.

"The recent market performance is a reminder of the stock market's resilience. While short-term gains are encouraging, long-term investors should focus on fundamentals and diversification," says Jennifer Martinez, a market analyst.

What's Next?

Looking ahead, all eyes will be on upcoming economic data, including inflation reports and Federal Reserve announcements. The Federal Reserve's stance on interest rates will be a critical factor in determining the market's trajectory. If the Fed signals a pause in rate hikes, it could further boost investor confidence.

In conclusion, the current market rally, led by the Dow Jones Industrial Average, Nasdaq, and S&P 500, has injected optimism into the financial markets. While the rebound is promising, investors should remain cautious and keep a close watch on economic indicators and corporate earnings. The coming weeks will be crucial in determining whether this rally is sustainable or just a temporary bounce.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.