Eli Lilly Makes History as First $1T Pharma Stock

Eli Lilly Makes History as First $1 Trillion Pharmaceutical Company

In a landmark moment for the pharmaceutical industry, Eli Lilly & Co. (LLY) became the first drugmaker to achieve a market capitalization exceeding $1 trillion on Friday, November 21, 2025. The stock briefly touched an all-time intraday high of $1,061 before pulling back slightly, marking a new era for Big Pharma and highlighting the immense value investors see in its innovative portfolio.

Market Context: Fed Lifeline and Tech Turmoil

The milestone occurred against a backdrop of a broader market rally fueled by optimism about a potential Federal Reserve interest rate cut. New York Fed President John Williams' remarks suggesting a chance for a December rate cut sent a wave of enthusiasm through Wall Street, with the likelihood of a cut spiking to 73% according to the CME FedWatch tool. However, this enthusiasm wasn't evenly distributed. While the S&P 500 and Nasdaq fluctuated, tech giants faced ongoing pressures. Notably, Nvidia (NVDA) remained under scrutiny due to persistent concerns about artificial intelligence overspending, illustrating that the market's recovery is sector-dependent.

Driving Forces Behind Eli Lilly's Success

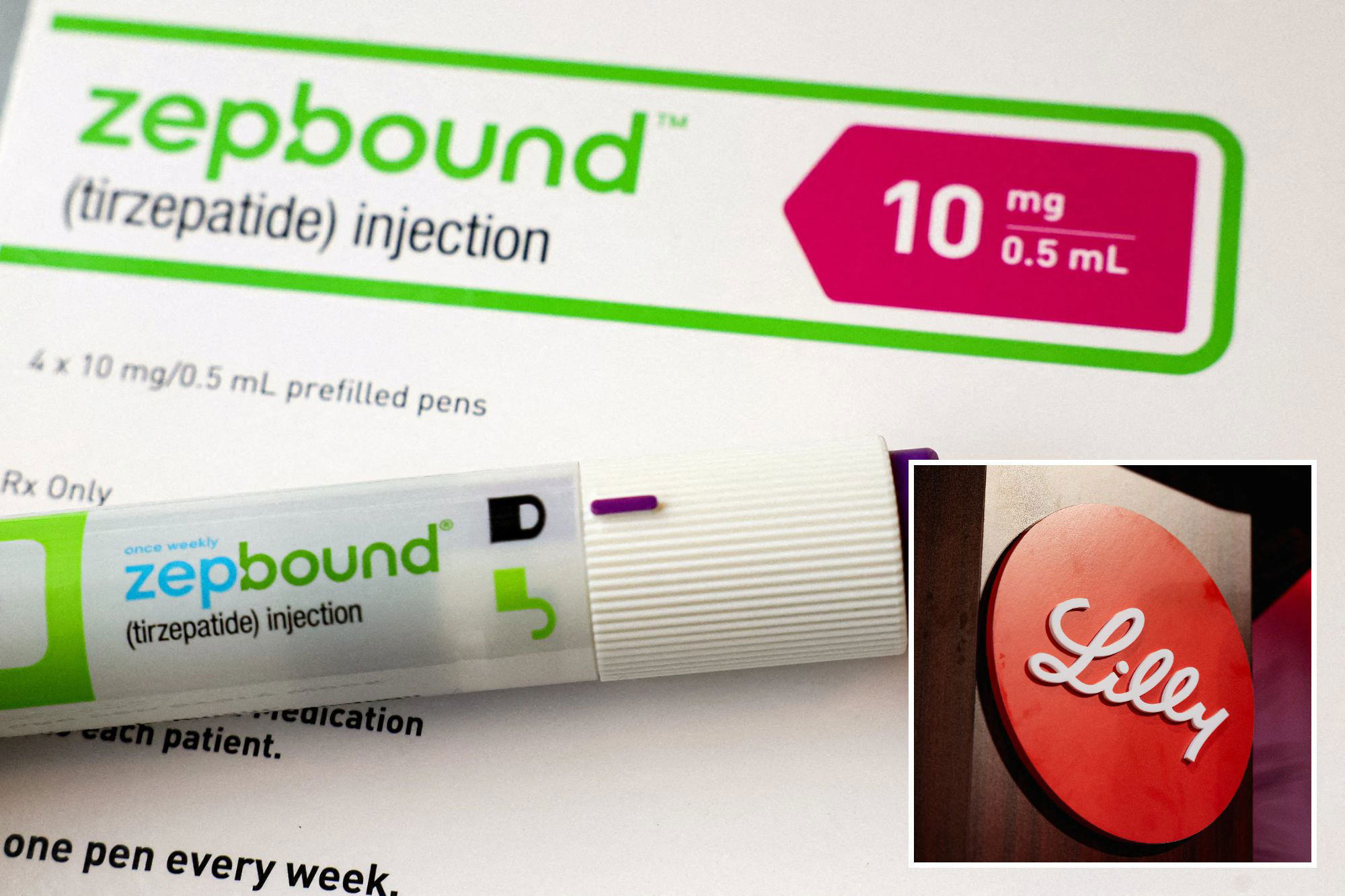

Eli Lilly's ascent to the $1 trillion club is largely attributed to its blockbuster GLP-1 injectable drugs, which have revolutionized the treatment of obesity and type 2 diabetes. These medications, including Mounjaro and Zepbound, have seen unprecedented adoption rates. The company is set to further solidify its dominance with the launch of an oral version of these drugs next year. Additionally, Eli Lilly recently made headlines by striking a deal with the Trump administration to lower the prices of its popular weight loss treatments, a move aimed at ensuring broader access while navigating the complex U.S. healthcare landscape.

Ripple Effects Across Industries

The rapid adoption of GLP-1 drugs is having profound effects beyond the pharmaceutical sector. Analysts at Piper Sandler have noted a significant impact on the food and beverage industry, leading to reduced price targets for companies in that space. As consumers using these medications experience reduced appetite, the demand for food has shifted. This has prompted investors to pivot towards companies less exposed to these trends. For instance, Jim Cramer's Investing Club highlighted a shift towards household product giants like Procter & Gamble (PG) and Kimberly-Clark, as their consumer staples are less likely to be affected by the changing eating habits of millions.

What's Next for Eli Lilly and Investors?

With the $1 trillion valuation now in its rearview mirror, all eyes are on Eli Lilly's next moves. The upcoming launch of the oral GLP-1 pill represents a critical next step, potentially expanding its user base even further. Meanwhile, the company's ability to innovate and navigate regulatory and pricing challenges will be key to sustaining its growth trajectory. For investors, Eli Lilly's success story underscores the potential of the biotech sector and the importance of staying ahead of major healthcare trends. However, the stock's meteoric rise also prompts questions about valuation and future growth potential.

Conclusion

Eli Lilly's achievement of a $1 trillion market cap is not just a personal victory but a testament to the transformative power of scientific innovation in addressing global health challenges. As the company forges ahead, it sets a new benchmark for the pharmaceutical industry and offers a compelling narrative for investors interested in the intersection of health and market leadership.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.