Fear & Greed Index: Mastering Market Sentiment

Understanding the Fear & Greed Index

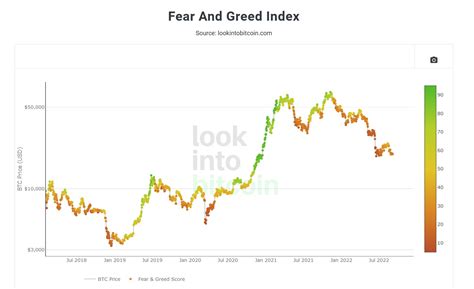

In the volatile world of investing, market sentiment often drives more price movements than fundamentals. The Fear & Greed Index is a powerful tool that quantifies this collective psychology, helping investors gauge whether the market is driven by panic or euphoria. Originally developed by CNN Money, this indicator aggregates seven key metrics to provide a daily snapshot of investor emotions.

At its core, the Fear & Greed Index operates on a scale of 0 to 100:

- 0-24: Extreme Fear - Often signals market bottoms and buying opportunities

- 25-44: Fear - Indicates cautious investor behavior

- 45-55: Neutral - Balanced market conditions

- 56-75: Greed - Shows growing investor optimism

- 76-100: Extreme Greed - Typically precedes market corrections

The Seven Components Behind the Index

The index's power lies in its multi-faceted approach, combining diverse data points:

- Market Momentum - Tracks price strength and volatility

- Put/Call Volume - Measures hedging activity (high put volume = fear)

- Safe Haven Demand - Gold vs. stock performance

- Market Volatility (VIX) - The "fear gauge" of the S&P 500

- Safe-Haven Flow - Treasury bond performance

- Insider Trading - Corporate executive buying/selling patterns

- Junk Bond Demand - High-yield bond spreads vs. Treasuries

Why Market Sentiment Matters

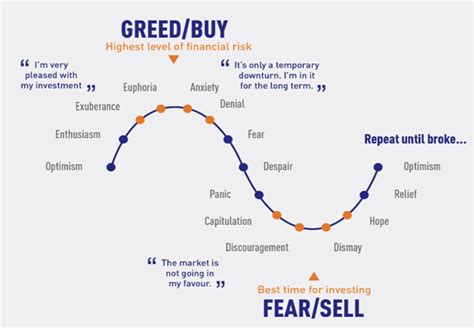

Contrarian investors particularly rely on the Fear & Greed Index because it highlights emotional extremes. When the index shows "Extreme Fear," history suggests markets are oversold. Conversely, "Extreme Greed" readings often precede pullbacks. For example, during the March 2020 COVID crash, the index hit 12 (Extreme Fear), marking a significant buying opportunity.

However, the index isn't a crystal ball. It works best as a supplementary tool, not a standalone signal. Always combine sentiment analysis with:

- Technical analysis of price trends

- Fundamental evaluation of company health

- Economic indicators and sector rotations

Practical Applications for Investors

Here's how to leverage the Fear & Greed Index in your strategy:

- Identify Reversal Zones: Extreme readings often precede trend changes

- Manage Portfolio Risk: Consider reducing exposure during "Extreme Greed" periods

- Dollar-Cost Averaging: Use "Fear" zones to increase investment allocations

- Sector Rotation: Shift toward defensive sectors during high fear

Remember that sentiment changes rapidly. The index updates daily, making it ideal for tactical decisions rather than long-term strategy. Always monitor multiple indicators to confirm signals.

The Psychology Behind the Numbers

Market sentiment reflects human behavior patterns:

"Greed makes investors chase rising prices, while fear forces them to sell at bottoms. The Fear & Greed Index visualizes this cycle, turning emotional reactions into measurable data."

Limitations to Consider

While invaluable, the index has constraints:

- Lags during black swan events

- May not reflect institutional sentiment accurately

- Works best in established trends rather than sideways markets

Always pair sentiment analysis with other tools. Check the current index reading on financial platforms like CNN Money or alternative data providers for real-time insights.

Conclusion

The Fear & Greed Index transforms abstract market psychology into actionable intelligence. By quantifying investor emotions, it helps investors avoid herd mentality and make contrarian decisions when opportunities arise. While not infallible, it remains an essential component for sophisticated market analysis.

Track the index regularly, but never let sentiment alone drive your decisions. Combine it with your research to navigate market cycles with greater confidence.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.