FOMC Minutes Signal Hawkish Shift: Dollar Strengthens

Understanding the FOMC's Market Influence

The Federal Open Market Committee (FOMC) meeting minutes are among the most-watched economic events in global finance. Released three weeks after each Federal Reserve meeting, these detailed transcripts reveal policymakers' internal debates and future policy intentions. Recent minutes from the October 28-29, 2025, session have sent ripples through currency markets, signaling a potential shift toward a more hawkish stance that's strengthening the US dollar.

Key Takeaways from the October 2025 Minutes

The latest FOMC minutes revealed several critical developments:

- Hawkish Dissent: Several members explicitly opposed further interest rate cuts, breaking from previous consensus. This "no-cut" faction argued that the labor market and inflation data warranted maintaining current rates.

- Inflation Focus: Policymakers emphasized persistent inflation risks over labor market concerns, with Boston Fed President Susan Collins and Kansas City Fed President Esther George advocating for continued vigilance against price pressures.

- Tariff Uncertainty: Members expressed skepticism about the temporary nature of proposed tariffs, noting potential long-term inflationary impacts from trade disruptions.

- Data-Dependent Path: Richmond Fed President Thomas Barkin underscored that future decisions would hinge heavily on incoming economic data, particularly inflation and employment reports.

Market Reaction: Dollar Rally Across the Board

Financial markets responded swiftly to the minutes' hawkish tone. The US dollar surged against major currencies:

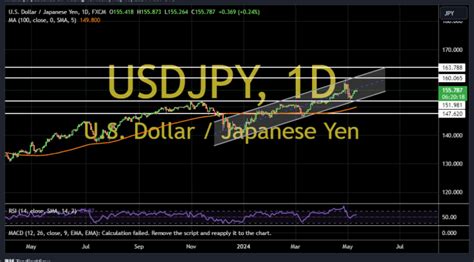

- USD/JPY: Jumped to 156.88 (+1.34%), breaching the psychologically significant 155 level.

- EUR/USD: Declined to 1.1580 as the dollar strengthened.

- GBP/USD: Fell to 1.3120 amid broad dollar strength.

This movement reflects traders pricing in reduced probability of December rate cuts, with markets now expecting the Fed to hold rates steady through year-end.

Supporting Economic Data

The Fed's hawkish stance was reinforced by complementary economic data:

"The US trade deficit unexpectedly narrowed to $596 billion in August, the smallest since June, as imports plunged 5.1% while exports remained stable. This improvement suggests stronger-than-expected Q3 GDP growth."

Meanwhile, Eurozone inflation held steady at 2.1% in October, meeting expectations and reducing pressure for immediate ECB action. These developments collectively reinforced the dollar's upward trajectory.

Yen Weakness Amplifies Dollar Gains

The Japanese yen emerged as the biggest loser in this dynamic, with USD/JPY reaching multi-month highs. Key factors driving yen weakness include:

- Delay in Bank of Japan rate hike expectations following disappointing GDP growth

- Persistent concerns about Japanese fiscal expansion

- Global carry trade activity benefiting from interest rate differentials

Technical analysts note that USD/JPY is now trading above its 200-day moving average (147.74), signaling potential further upside.

What Lies Ahead for Traders

As we move forward, market participants should focus on:

- Upcoming US inflation data (CPI, PCE) for inflation confirmation

- Nonfarm Payrolls reports for labor market insights

- Global trade tensions and tariff developments

- Bank of Japan policy signals

The FOMC minutes have fundamentally shifted market expectations, making dollar strength the dominant theme for Q4 2025. Traders should prepare for heightened volatility around key data releases, particularly as the Fed maintains its "higher for longer" policy stance.

[IMAGE_3]Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.