Forget NVDA: 2 AI Stocks Crushing It in 2025

Introduction

NVIDIA (NVDA) has dominated headlines with its 36.6% surge in 2025, fueled by insatiable demand for its AI chips and CUDA platform. But as U.S.-China trade tensions and intensifying competition from AMD and Intel create headwinds, savvy investors are looking beyond the obvious tech giant. Two lesser-known AI stocks are not just keeping pace—they're crushing NVDA's performance with triple-digit gains and still have significant upside potential as the AI revolution accelerates.

The NVDA Opportunity—and Its Risks

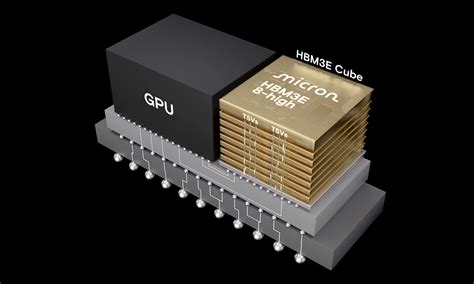

Micron Technology: Fueling AI's Memory Demands

Micron Technology (MU) has emerged as a stealth AI winner, with its shares skyrocketing 228.8% this year. The semiconductor giant is capitalizing on the explosive demand for high-bandwidth memory (HBM) chips—critical components that power AI training and inference. Micron's HBM chips offer superior data processing capabilities while reducing power consumption, making them indispensable for expanding AI infrastructure.

The company's results speak volumes. For fiscal Q2 2026, Micron projects revenue between $18.3 billion and $19.1 billion, up from Q1's $13.64 billion (a 56.8% year-over-year jump). Its cloud memory division is driving much of this growth, with earnings per share expected at $8.22–$8.62. Analysts forecast a robust 23.5% earnings growth rate for the next year, reinforcing Micron's position as a Zacks #1 (Strong Buy) stock.

BigBear.ai: Securing Government AI Contracts

With $250 million in cash reserves and a Zacks #2 (Buy) rating, BigBear.ai is well-funded for expansion. The company has also made significant strides toward profitability, projecting a stellar 73.1% earnings growth rate for the coming year. Its focus on defense and national security provides a stable revenue stream amid shifting tech landscapes.

Conclusion: Why Look Beyond NVDA?

While NVIDIA remains a cornerstone of the AI boom, Micron and BigBear.ai offer distinct advantages. Micron's HBM chips are irreplaceable for AI's hardware needs, while BigBear.ai's specialized government contracts provide recession-resistant growth. For investors seeking exposure to AI's next wave, these stocks present opportunities with less saturation and significant upside as the sector evolves.

Share this article

Sarah Johnson

Technology journalist with over 10 years of experience covering AI, quantum computing, and emerging tech. Former editor at TechCrunch.