Venmo Outage: What Down Detector Reveals

Venmo's Recent Outage: Insights from Down Detector

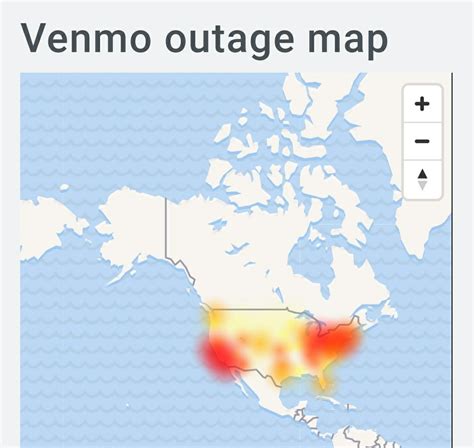

Recently, thousands of Venmo users experienced significant service disruptions when the popular payment app went down. According to outage tracking platform Down Detector, reports of problems peaked sharply, indicating a widespread technical issue. This incident highlights the critical role real-time monitoring services play in our digital financial ecosystem.

The Outage Experience

Users reported being unable to send or receive payments, check transaction histories, or even log into their accounts. The disruption lasted for several hours, causing frustration for individuals relying on Venmo for everyday transactions like splitting bills with friends or paying for services. As noted in recent reports, many users took to social media to express their concerns, with some even sharing screenshots of error messages.

How Down Detector Works

Down Detector aggregates user-submitted reports to create real-time outage maps and graphs. When Venmo malfunctioned, the platform showed a dramatic spike in problem reports across different regions, confirming it wasn't an isolated issue. This crowdsourced approach provides immediate visibility into service health, helping users determine whether problems are systemic or device-specific.

Impact on Users

For many, especially younger demographics and gig economy workers, Venmo isn't just a convenience—it's essential. The outage underscored how dependent we've become on digital payment platforms. Without access to funds or transaction records, users faced potential late fees, payment delays, and general inconvenience. This vulnerability becomes particularly concerning during critical moments like rent payments or business transactions.

What Happened Next?

Following the peak outage period, Venmo's parent company PayPal acknowledged the issue and worked to restore services. Most users reported full functionality returning within hours, though some lingering problems persisted temporarily. The company hasn't disclosed the exact technical cause, though such incidents often stem from server overload or software bugs during platform updates.

Lessons Learned

This incident serves as a reminder of both the fragility of digital infrastructure and the value of transparency. Services like Down Detector fill a crucial gap by giving users immediate, crowd-sourced information when official channels are slow to respond. For consumers, it highlights the importance of having backup payment methods readily available for essential transactions.

The Future of Digital Payments

As payment apps continue integrating deeper into our financial lives, reliability becomes paramount. While minor outages are inevitable in any complex system, the speed of resolution and communication remains key. Platforms like Venmo will need to invest in robust infrastructure and proactive monitoring to maintain user trust in an increasingly competitive market.

Conclusion

The recent Venmo outage, while disruptive, offers valuable insights into our digital payment ecosystem. Down Detector's role in aggregating user experiences provides both immediate relief and long-term accountability. As we continue embracing cashless transactions, incidents like these remind us that convenience must be balanced with resilience and transparency.

Share this article

Sarah Johnson

Technology journalist with over 10 years of experience covering AI, quantum computing, and emerging tech. Former editor at TechCrunch.