Google Stock: Tech Earnings Drive Market

Google Stock at the Crossroads of Tech Earnings and Consumer Data

The stock market is currently navigating a critical juncture, with Google's stock price reflecting broader economic uncertainties and sector-specific catalysts. While traders await pivotal earnings reports, particularly from AI giant Nvidia, key retail data from companies like Walmart and Target is casting long shadows over market sentiment. This confluence of factors creates both opportunities and risks for Google investors.

Market Momentum: Futures and the NVIDIA Catalyst

Recent market activity shows notable strength in futures markets. According to Yahoo Finance, Dow Jones futures, Nasdaq futures, and S&P 500 futures have all risen as investors brace for two major events: NVIDIA's earnings report and the latest jobs data. NVIDIA's results are particularly significant as the company has become a bellwether for artificial intelligence and semiconductor demand—sectors where Google maintains substantial exposure through its cloud computing and AI initiatives.

For Google, NVIDIA's performance could directly impact investor sentiment toward tech stocks. Strong NVIDIA results might boost confidence in Google's cloud growth prospects, while weaker guidance could trigger sector-wide sell-offs. The futures market is currently pricing in cautious optimism, but NVIDIA's announcement could dramatically shift this calculus.

The Consumer Conundrum: Retailers as Economic Oracles

While tech earnings dominate headlines, Bloomberg emphasizes that retail reports from Walmart and Target are gaining unprecedented importance. These companies serve as critical indicators of consumer health, a key driver of Google's core advertising revenue. As Bloomberg notes, "results from Walmart, Target and Home Depot are likely to overshadow Nvidia because they offer insights into spending patterns at a time when there’s scant data for Wall Street to go on."

Weak retail performance could signal broader economic headwinds, potentially reducing advertiser budgets on Google's platforms. Conversely, resilient consumer spending might bolster confidence in Google's advertising ecosystem. Traders will scrutinize same-store sales trends and consumer sentiment metrics embedded in these reports for actionable clues.

Google's Position in the Current Flow

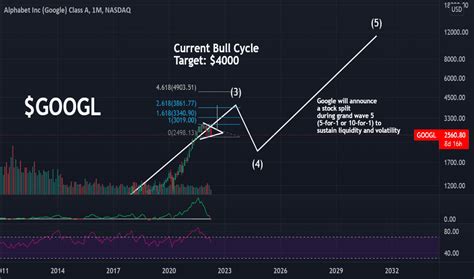

Google's stock is responding to this dual pressure. The company's diversified revenue streams—advertising, cloud, and hardware—offer some insulation, but its performance remains closely tied to macroeconomic trends. The market's flow of capital is currently favoring defensive sectors, creating headwinds for growth-oriented tech stocks like Google. However, long-term investors may see this as a buying opportunity amid short-term volatility.

What's Next for Google Investors?

Traders should watch three critical developments:

- NVIDIA's Earnings Report: AI momentum and cloud infrastructure spending will set the tone for tech valuations.

- Consumer Data from Retailers: Walmart and Target results will indicate discretionary spending health.

- Jobs Report: Employment data could influence Federal Reserve policy expectations.

For Google specifically, investors should monitor advertising revenue trends in upcoming quarterly reports and progress in integrating AI across its products. The interplay between tech innovation cycles and consumer resilience will ultimately determine whether Google can navigate this turbulent market phase successfully.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.