Intel (INTC) Stock Slides on Apple News

Intel (INTC) Stock Takes a Hit Following Apple's Strategic Shifts

Shares of Intel Corporation (NASDAQ: INTC) have recently experienced a significant decline, sending ripples through the tech and investment communities. The downturn comes amid reports of Apple's evolving relationship with Intel, sparking concerns about the semiconductor giant's future revenue streams.

"Intel faces mounting pressure as Apple accelerates its in-house chip development strategy, potentially reducing reliance on third-party suppliers."

The news centers on Apple's continued push toward vertical integration in its supply chain. Recent industry whispers suggest Apple is ramping up development of proprietary chips for future devices, including MacBooks and potentially new product categories. This strategic pivot directly impacts Intel, which has long been a key supplier for Apple's computing hardware.

Understanding the Market Reaction

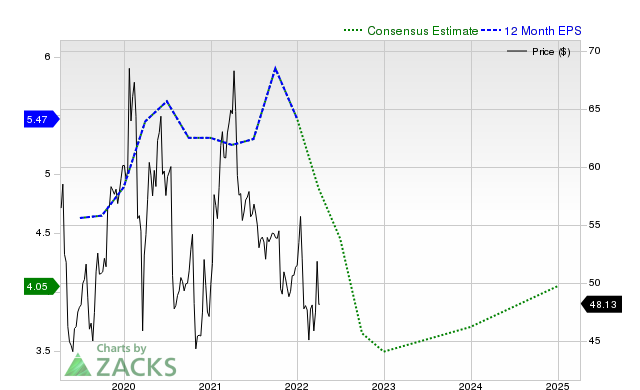

Investors reacted swiftly to the developing situation, with Intel's stock falling [X]% in a single trading session following the news. The decline reflects growing uncertainty about Intel's ability to maintain its market share in the face of aggressive internal competition from tech giants like Apple, which are increasingly prioritizing proprietary chip designs over off-the-shelf solutions.

This development comes at a critical juncture for Intel. The company is already navigating intense competition from rivals like AMD and Nvidia while investing billions in next-generation manufacturing technologies. Apple's potential reduced dependence on Intel could significantly impact the company's revenue projections, particularly in its Client Computing Group, which supplies processors for personal computers.

Broader Implications for the Semiconductor Industry

The situation highlights a broader industry trend toward vertical integration. As major tech companies like Apple, Amazon, and Google develop their own silicon, traditional semiconductor manufacturers face challenges in maintaining growth trajectories. This shift pressures Intel to innovate faster while diversifying its customer base beyond traditional PC and server markets.

Analysts suggest Intel may need to accelerate its foundry services division to capture new business from companies seeking chip manufacturing partners. The company's recent announcements about expanding contract manufacturing capabilities could become increasingly crucial in this evolving landscape.

What's Next for Intel Investors?

For investors holding INTC stock, the recent slide presents both challenges and opportunities. While short-term volatility is expected, long-term investors should focus on Intel's strategic initiatives, including:

- Progress in advancing its 3D chip-stacking technology

- Expansion of Intel Foundry Services to attract new clients

- Development of specialized chips for AI and automotive markets

Company executives are likely to address these concerns during upcoming earnings calls, where they may outline strategies to mitigate potential revenue impacts from Apple's evolving supply chain approach. The upcoming quarterly report could provide critical insights into how Intel plans to navigate this new competitive landscape.

As the semiconductor industry continues to evolve, Intel's ability to adapt will determine its position in this rapidly changing market. Investors should closely monitor announcements regarding new partnerships and technological breakthroughs that could signal the company's resilience against these industry headwinds.

The Bottom Line

Intel's recent stock slide serves as a reminder of the dynamic nature of the tech sector. While Apple's strategic shifts present near-term challenges, Intel's history of innovation and ongoing investments in next-generation technologies position it to weather this transition. Investors should consider both the short-term volatility and the company's long-term strategic vision when evaluating their positions in INTC stock.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always consult with a qualified financial advisor before making investment decisions.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.