J&J Buys Halda Therapeutics for $3.05B

Industry Giant J&J Makes Strategic $3.05B Move into Precision Oncology

Johnson & Johnson (J&J) has announced a landmark acquisition deal, purchasing precision cancer therapy developer Halda Therapeutics for $3.05 billion in cash. The transaction, finalized on November 17, 2025, represents a significant strategic expansion of J&J's oncology portfolio, particularly in the high-growth areas of solid tumors and prostate cancer treatment.

What Does Halda Bring to J&J?

Halda Therapeutics, a clinical-stage biotech startup, specializes in developing novel precision therapies for difficult-to-treat cancers. While specific pipeline details remain limited, the acquisition signals J&J's confidence in Halda's innovative approach to targeting molecular pathways in aggressive cancers. This move directly complements J&J's existing oncology pipeline, which includes established treatments like prostate cancer drug Erleada.

Strategic Rationale Behind the Deal

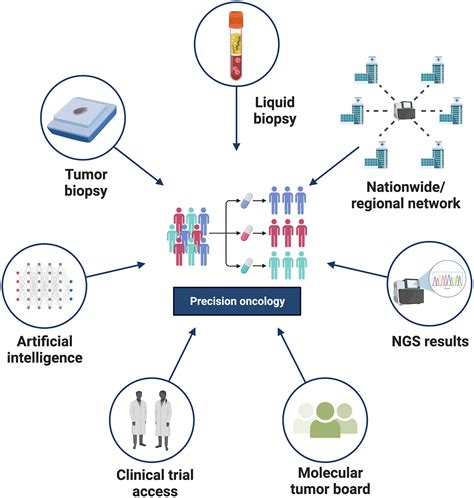

The acquisition reflects broader trends in the pharmaceutical industry where major players are aggressively pursuing innovative biotech assets through high-value acquisitions. By acquiring Halda, J&J gains:

- Entry into precision oncology platforms

- Novel mechanisms for targeting solid tumors

- Scientific expertise in molecularly guided therapies

- Accelerated development timelines for next-generation treatments

"This acquisition positions J&J at the forefront of precision oncology innovation," commented industry analysts following the announcement. "It's a clear signal that the company is willing to invest heavily in transformative cancer technologies."

"Precision medicine is no longer a niche concept—it's becoming the standard of care in oncology. This acquisition gives J&J immediate access to cutting-edge platforms."

- Healthcare M&A Analyst

Context in the Biotech M&A Landscape

The Halda deal comes amid a flurry of major pharmaceutical transactions. Just weeks prior, J&J's competitors engaged in similar high-stakes acquisitions, including Pfizer and Novo Nordisk's bidding war for weight-loss drugmaker Metsera. This consolidation wave highlights pharmaceutical companies' urgency to secure promising platforms in high-value therapeutic areas.

Implications for Cancer Treatment

For patients, the deal promises accelerated development of more targeted therapies. Halda's research focuses on personalizing treatments based on individual tumor biology—a critical advancement for cancers with limited treatment options. J&J's vast resources and global market reach could potentially shorten the path from laboratory to clinic for these promising therapies.

"The integration of Halda's technology with J&J's clinical development capabilities could significantly speed up the availability of next-generation cancer treatments," said oncology researchers familiar with the companies' work.

What's Next?

While the deal structure remains straightforward—all cash acquisition with no financing contingencies—industry watchers will monitor several key developments:

- Integration of Halda's scientific team into J&J's research division

- Public disclosure of Halda's clinical pipeline

- Timeline for potential FDA filings of lead candidates

- Impact on J&J's broader oncology strategy

As precision oncology continues its rapid evolution, this acquisition underscores the pharmaceutical industry's commitment to investing in transformative cancer care technologies. For J&J, the Halda acquisition represents not just a financial transaction but a strategic leap into the future of personalized medicine.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.