Market Rallies Then Falters After Nvidia Earnings

Markets Swing Wildly Amid AI Boom and Economic Signals

Stock markets experienced dramatic volatility this week, with major indices rallying sharply following blockbuster earnings from tech giant Nvidia and stronger-than-expected jobs data, only to give up gains as concerns resurfaced about an artificial intelligence bubble.

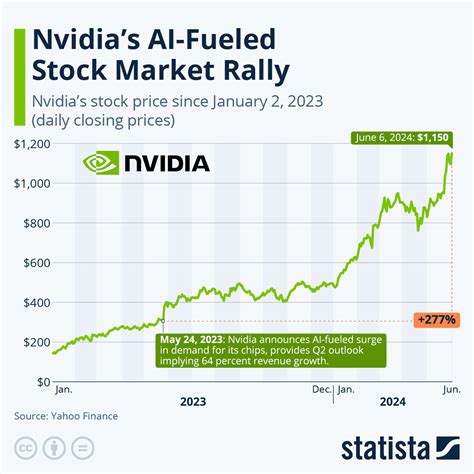

Nvidia Ignites Tech Rally

The catalyst came Wednesday night when Nvidia reported Q3 results that blew past expectations. The $4.7 trillion semiconductor powerhouse saw its stock surge after revealing 62% revenue growth, driven by unprecedented demand for its AI chips. CEO Jensen Huang's forecast of continued "off-the-charts" sales temporarily silenced skeptics who had warned of an AI bubble.

"The earnings blowout from Nvidia late Wednesday appeared to rebuke such concerns, however, temporarily reviving enthusiasm for an AI trade that has propelled much of the market gains this year," reported ABC News.

Jobs Data Fuels Optimism (Briefly)

Thursday morning brought further good news with a stronger-than-expected jobs report. The U.S. economy added 119,000 jobs in September—far exceeding economists' forecasts—defying recent hiring slowdown concerns. The fresh data suggested resilience in the labor market, boosting expectations for an upcoming Federal Reserve interest rate cut.

"The odds of a quarter-point rate cut ticked up from 33% on Wednesday afternoon to 43% on Thursday morning, according to the CME FedWatch Tool," the ABC report noted.

Selloff Exposes Market Jitters

Yet the optimism proved short-lived. By midday Thursday, markets reversed course, erasing earlier gains. The Dow Jones fell 0.1%, while the S&P 500 dropped 0.2% and the tech-heavy Nasdaq slid 0.3%—a stark reversal from morning highs.

The selloff reflected persistent uncertainty about the economy's trajectory. While Nvidia's performance validated the AI sector, inflation remains elevated, and a revised August jobs report showed far weaker hiring than initially reported (downward to 4,000 jobs lost from 22,000 gained). Meanwhile, Walmart's strong earnings provided mixed messages about consumer spending health.

Broader Economic Context

Markets have had a strong 2025 overall, with the S&P 500 soaring 15%, the Dow climbing 10%, and the Nasdaq jumping 19%. However, underlying tensions persist:

- Stagflation Fears: Rising inflation coupled with hiring slowdowns pose a double-threat.

- Fed Dilemma: The central bank must balance inflation control with employment goals.

- Valuation Concerns: Tech valuations remain elevated amid AI enthusiasm.

What Comes Next?

Investors now focus on upcoming Fed meetings for rate-cut signals and continued monitoring of AI sector performance. While Nvidia's earnings demonstrate the sector's potential, the market's whipsaw movements underscore how economic uncertainty and valuation concerns can quickly overshadow even the most positive news.

Key Takeaways

"Markets remain caught between the undeniable momentum of AI and persistent economic headwinds. Nvidia's success proves the technology's viability, but the broader economy's health will ultimately determine whether this rally sustains."

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.