MicroStrategy Stock: Riding the Bitcoin Wave

In the volatile world of cryptocurrency investments, few stocks have captured investors' attention quite like MicroStrategy (MSTR). Once known primarily for its business intelligence software, MSTR has transformed into a proxy for Bitcoin exposure, making it one of the most talked-about stocks in recent financial markets.

The MicroStrategy-Bitcoin Connection

MicroStrategy's pivot to Bitcoin began in 2020 when CEO Michael Saylor initiated a radical treasury reserve strategy. The company started converting cash holdings into Bitcoin, positioning itself as the world's largest corporate holder of the cryptocurrency. As of 2023, MicroStrategy's treasury holds over 200,000 BTC, valued at billions of dollars.

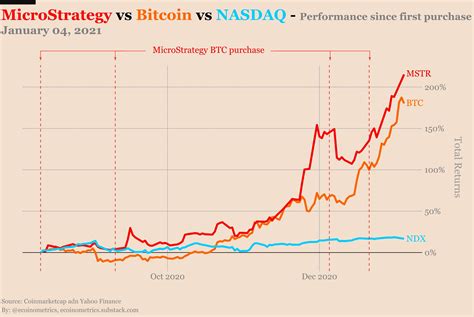

This strategic move has created an unprecedented correlation between MSTR's stock price and Bitcoin's market movements. When Bitcoin surges, MSTR often experiences amplified gains, while Bitcoin downturns can trigger significant stock declines. This dynamic has attracted both crypto enthusiasts and traditional investors seeking indirect Bitcoin exposure.

Why Investors Are Watching MSTR Closely

Several factors make MSTR stock particularly compelling for market observers:

- Leveraged Bitcoin Play: Each share of MSTR represents approximately 0.0021 BTC, offering investors a way to gain exposure without directly holding cryptocurrency.

- Institutional Adoption Signal: MicroStrategy's massive Bitcoin holdings signal growing institutional confidence in cryptocurrency as a legitimate asset class.

- Corporate Treasury Model: Other companies are considering similar Bitcoin treasury strategies, potentially creating a wave of new institutional demand.

The Risks of the Bitcoin Bet

While the potential rewards are significant, MSTR's strategy comes with substantial risks:

- Extreme Volatility: Both Bitcoin and MSTR can experience price swings exceeding 20% in a single day.

- Regulatory Uncertainty: Changing cryptocurrency regulations could impact the value of MicroStrategy's holdings.

- Competitive Pressure: Other companies are entering the Bitcoin space, potentially diluting MicroStrategy's first-mover advantage.

"We believe Bitcoin is the strongest, most liquid, most decentralized monetary network in the world." - Michael Saylor, MicroStrategy CEO

What's Next for MSTR?

Market analysts suggest several potential catalysts for MSTR's future performance:

- Further Bitcoin price appreciation could drive significant gains li>Regulatory clarity on cryptocurrency might stabilize the market li>Continued Bitcoin adoption by other corporations

For investors considering MSTR, thorough research is essential. The stock represents not just a business investment but a bet on the future of cryptocurrency as a whole. Those with high-risk tolerance and long-term investment horizons may find it appealing, while conservative investors might prefer less volatile options.

Key Takeaways

MicroStrategy stock has evolved into a unique investment vehicle that bridges traditional finance and cryptocurrency markets. Its success is now intrinsically linked to Bitcoin's performance, making it both an opportunity and a risk for investors. As cryptocurrency continues to mature, MSTR's role as a Bitcoin proxy could become increasingly significant in the broader financial landscape.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.