Morgan Stanley Predicts 16% S&P 500 Rally

Why Morgan Stanley Is Betting Big on a 16% S&P 500 Surge

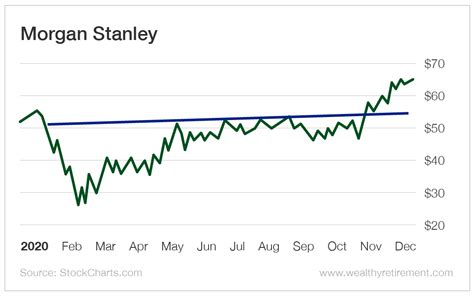

Wall Street's sentiment is shifting dramatically, with Morgan Stanley emerging as one of the most prominent bulls on the market. The financial giant has issued a bold forecast: a 16% rally in the S&P 500 by year-end 2025, driven by its strong preference for U.S. stocks over global markets. This optimistic outlook places Morgan Stanley among the top stock bulls today, reinforcing growing confidence in American equities.

Key Drivers Behind the Rally

Morgan Stanley's bullish stance stems from several strategic factors:

- U.S. Market Dominance: The firm highlights superior corporate earnings growth and economic resilience in the U.S. compared to international peers.

- Interest Rate Expectations: Anticipation of stabilizing interest rates is expected to boost investor appetite for riskier assets.

- AI and Tech Boom: Continued advancements in artificial intelligence and technology sectors are seen as primary growth catalysts.

"U.S. stocks offer a more compelling risk-reward profile for 2026. We see meaningful upside potential as domestic fundamentals outshine global alternatives."

— Morgan Stanley Research Team

Global vs. U.S. Markets

While Morgan Stanley acknowledges global market volatility, it specifically favors U.S. equities for their:

- Stronger consumer spending

- Innovative corporate strategies

- More stable policy environments

This divergence in performance expectations reflects Morgan Stanley's belief that U.S. companies are better positioned to navigate economic uncertainties in 2026.

What This Means for Investors

For individual investors, Morgan Stanley's forecast suggests:

- Potential portfolio rebalancing toward U.S. large-cap stocks

- Opportunities in technology and consumer discretionary sectors

- Caution regarding overexposure to international equities

The Road Ahead

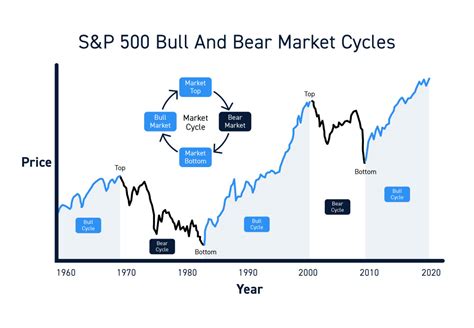

While the 16% projection appears ambitious, Morgan Stanley analysts point to historical precedents where similar rallies occurred during periods of economic recovery and innovation booms. However, they caution that geopolitical risks and inflation remain wildcards that could impact timelines.

As 2025 progresses, all eyes will be on corporate earnings reports and Federal Reserve policy decisions to validate or challenge this bullish thesis. For now, Morgan Stanley's call sends a powerful signal of confidence in the enduring strength of the U.S. market.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.