MSTR: How MicroStrategy Became Bitcoin's Wild Stock

The Unlikely Connection: MicroStrategy and Bitcoin

When most investors think of Bitcoin exposure, they imagine buying cryptocurrency directly. But a surprising alternative has emerged: MicroStrategy (MSTR). This once-obscure enterprise software company has transformed into a volatile stock that trades like a Bitcoin proxy, captivating Wall Street and retail investors alike.

The Bitcoin Bet That Rewrote Corporate Finance

Under CEO Michael Saylor's leadership, MicroStrategy made headlines in 2020 by converting its corporate treasury into Bitcoin. Instead of holding cash reserves, the company began purchasing Bitcoin as its primary reserve asset—a move that defied traditional financial wisdom. Since then, MicroStrategy has accumulated over 190,000 BTC, worth billions at current prices, using its own stock as collateral for additional purchases.

"Bitcoin is a superior form of money," Saylor has repeatedly stated, framing the strategy as a hedge against inflation.

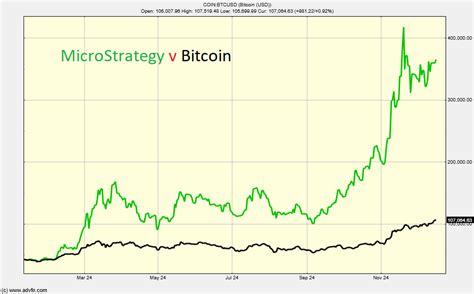

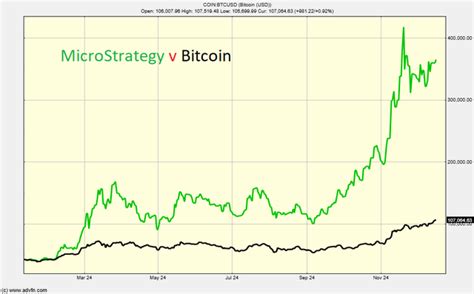

This aggressive approach has created a unique correlation: MicroStrategy's stock price now moves in tandem with Bitcoin's value, often amplifying its volatility. When Bitcoin surges, MSTR can jump even higher; when crypto markets dip, the stock tends to fall sharply.

Why Investors Flock to MSTR

For many, MSTR offers an indirect way to gain Bitcoin exposure through a regulated security. Key advantages include:

- Tax Benefits: Potential tax advantages compared to direct crypto holdings

- Leverage: Stock price often outperforms Bitcoin's movements

- Liquidity: Easier to trade than physical Bitcoin

The Risks Behind the Rally

While MSTR's correlation with Bitcoin has created explosive gains, it's not without risks. The stock's extreme volatility can lead to significant losses during crypto downturns. Additionally, regulatory scrutiny is growing, with the SEC examining how such "Bitcoin stocks" should be classified. The company's heavy reliance on Bitcoin also means its financial health is intrinsically tied to crypto market sentiment.

What's Next for MicroStrategy?

Analysts debate whether MSTR can maintain its Bitcoin momentum. Proponents argue Saylor's vision will position MicroStrategy as a long-term Bitcoin leader, while skeptics warn of potential regulatory crackdowns or market corrections. As Bitcoin adoption evolves, MicroStrategy's strategy will remain a fascinating case study in corporate innovation versus financial orthodoxy.

Whether you're a crypto believer or traditional finance skeptic, MicroStrategy's journey highlights how digital assets are reshaping investment paradigms.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.