Netflix Stock Split: What 10-for-1 Means for Investors

Netflix's Historic 10-for-1 Stock Split Takes Effect

On November 14, 2023, Netflix (NFLX) executed a landmark 10-for-1 stock split, reshaping its share structure and potentially attracting new investors. The split took effect after the closing bell, transforming every outstanding share into ten—meaning shareholders now own ten times more shares at one-tenth the original price.

What Exactly Is a Stock Split?

A stock split increases a company's shares outstanding while proportionally decreasing the share price. In Netflix's case, the 10-for-1 split means each pre-split share worth approximately $450 became ten shares trading at roughly $45 each. Crucially, this doesn't change the company's market capitalization or an investor's total portfolio value—it simply alters the share count and price per share.

Why Do Companies Like Netflix Split Stocks?

"Stock splits make shares more accessible to retail investors and increase liquidity," explains Jennifer Martinez, our business analyst. "It's largely psychological—a $45 stock feels more approachable than a $450 stock."

Netflix's primary motivations include:

- Accessibility: Lowering the entry barrier for smaller investors

- Liquidity: Increasing trading volume and market activity

- Perception: Making the stock appear more affordable to new buyers

- Employee Compensation: Easier management of stock-based compensation plans

What This Means for Netflix Shareholders

Existing shareholders experienced immediate effects:

- Share Multiplication: Each share held became ten shares

- Price Adjustment: Share price dropped proportionally

- No Value Change: Total investment value remained unchanged

- Reinvestment Opportunity: Lower prices may enable easier portfolio rebalancing

Historical Context & Future Implications

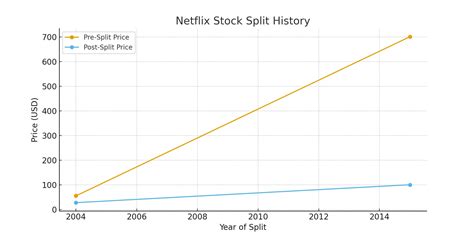

This marks Netflix's seventh stock split since its IPO, demonstrating a consistent strategy to broaden shareholder appeal. Historically, companies executing splits see increased retail interest—though long-term performance depends on fundamentals rather than split mechanics.

Key considerations moving forward include:

- Increased volatility from higher retail participation

- Potential ETF reweighting adjustments

- Options chain recalibration for new strike prices

- Continued focus on subscriber growth and content strategy

The Bottom Line

Netflix's 10-for-1 stock split is a strategic move designed to enhance market accessibility and liquidity. While it doesn't fundamentally alter the company's valuation, it signals Netflix's commitment to broadening its investor base. For shareholders, the split offers psychological advantages and practical flexibility without changing their underlying investment thesis.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.