No Tax on Overtime? Not in All States

Recent federal legislation introduced exciting tax breaks—including exemptions for overtime pay and tips—but many Americans are discovering that these benefits won't apply everywhere. As states grapple with budget shortfalls and economic uncertainty, several jurisdictions are decoupling from new federal tax provisions, leaving workers with higher-than-expected state tax bills.

President Trump's One Big Beautiful Bill Act (OBBBA) signed in July 2025 promised significant relief for workers, including the elimination of federal taxes on overtime earnings and tip income. However, states aren't required to conform to federal tax codes, and budget pressures are forcing many to reject these benefits.

Where the Exemptions Don't Apply

Washington, D.C. made headlines by passing an emergency tax bill suspending several OBBBA provisions. Effective retroactively to January 1, 2025, D.C. residents can no longer claim:

- No tax on overtime pay

- No tax on tips

- $6,000 senior tax deduction

- Charitable contribution deductions for non-itemizers

The move is expected to save the district $567 million through fiscal year 2029, though qualifying seniors could lose $360–$390 annually in deductions.

D.C. isn't alone. Other states are also rejecting key provisions:

- Colorado: Requires taxpayers to "add back" federally exempt overtime income on state returns.

- New York: Continues taxing tips/overtime via "add-back" codes on IT-225 forms.

- Illinois: Updating Schedule M to include add-backs for federally exempt tips/overtime.

- Maine: Rejected senior deductions, car loan interest, tips, and overtime exemptions.

Why States Are Decoupling

As COVID-era federal aid depletes and economic uncertainty grows, states are hunting for revenue. The Tax Foundation notes that OBBBA conformity is causing "havoc on state budgets," with many seeing forecasted revenue drop significantly. By rejecting federal breaks, states protect their budgets but shift the burden onto workers.

"You must pay close attention to state adjustments for the next few years, as each state's approach differs. This complexity makes DIY tax preparation less viable for affected clients."

— Eric Clements, Director of Tax Compliance at Thomson Reuters

What This Means for Taxpayers

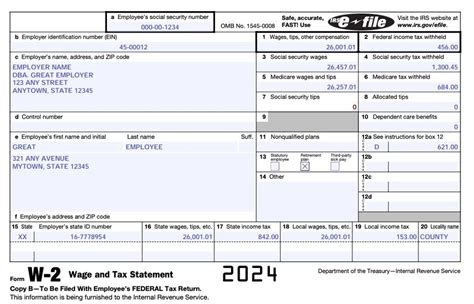

If you live in a decoupling state:

- Review state tax forms: Look for new "add-back" lines requiring you to report federally exempt income.

- Calculate impact: For a worker making $10,000 in overtime, state taxes could add $500–$1,000 in liability.

- Consider professional help: State-specific rules make DIY preparation risky for affected taxpayers.

Illinois provides a clear example: while the federal government exempts overtime from taxation, state residents will still pay income tax on those earnings unless the legislature reverses course.

What's Next?

States like D.C. have temporary suspensions in place, but permanent decoupling could become more common. Lawmakers nationwide are evaluating the trade-offs of adopting OBBBA provisions, with budget pressures likely driving further splits between federal and state tax codes.

For workers, the lesson is clear: don't assume federal tax breaks apply to your state return. Consult a tax professional to navigate the evolving landscape and avoid unexpected liabilities.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.