Nvidia Earnings Today: A Make-or-Break Moment for AI?

Nvidia Earnings Today: A Make-or-Break Moment for AI?

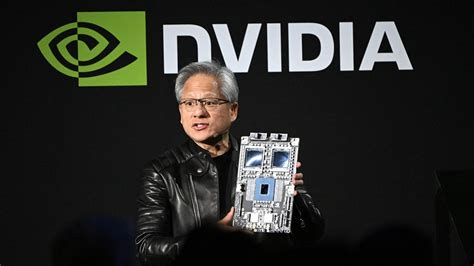

As the tech world holds its breath, Nvidia is set to release its Q3 earnings report, a pivotal moment that could redefine the trajectory of the artificial intelligence market. With investors anxiously watching for signs of sustainable growth amid concerns over potential AI overbuilding, this earnings call isn't just another quarterly update—it's a referendum on the future of the AI boom. As markets stabilize following recent volatility, all eyes are on the chipmaker whose chips power the AI revolution.

The High Stakes of Nvidia's Q3 Report

Nvidia's dominance in the AI chip market is undeniable, driving unprecedented growth as companies scramble to integrate generative AI into their operations. However, dark clouds are gathering on the horizon. Investor concerns about AI overbuilding suggest that demand for high-end GPUs may be overheating, risking a potential market correction. This fear stems from reports of excess inventory and slowing enterprise adoption in certain sectors. The upcoming earnings report will provide critical clarity on whether these concerns are justified or just market noise.

Analysts are forecasting record revenue, but the real focus will be on forward guidance and growth sustainability. A miss or cautious outlook could trigger significant volatility in Nvidia stocks and ripple across the broader market, especially for the S&P 500, heavily weighted in tech. As Bloomberg notes, this report serves as a "pivotal test for big tech," with traders reframing their strategies based on Nvidia's performance.

Market Context: A Waiting Game

The broader financial landscape adds another layer of complexity to Nvidia's earnings. After bruising losses that pushed the S&P 500 into its longest downturn since August, markets show tentative signs of recovery. Treasury yields have stabilized, and the dollar has strengthened slightly, but traders remain cautious. Bitcoin's dip below $92,000 further underscores the risk-averse sentiment dominating Wall Street.

"Stocks steadied after a bruising run of losses, with traders refraining from taking big bets ahead of Nvidia Corp.'s earnings," reports Bloomberg. This hesitation highlights Nvidia's outsized influence—the company's market cap rivals entire economies, and its stock movements can sway global indices. Any hint of weakening AI demand could reignite sell-offs, while robust results could ignite a rally across tech sectors.

Key Metrics to Watch

When Nvidia's earnings drop, investors will dissect three crucial areas:

- Revenue Growth vs. Projections: Consensus estimates point to a 30%+ year-over-year jump. Exceeding this could validate the AI narrative; missing it would fuel overbuilding fears.

- Data Center Segment Performance: This powerhouse division accounts for over 80% of Nvidia's revenue. Slowing growth here would signal enterprise fatigue.

- Gross Margins: Pricing power amid supply constraints is critical. Margin compression could indicate competitive pressure or discounting.

"This is a make-or-break moment for AI-addicted markets," warns one analyst. "Nvidia isn't just reporting numbers—they're setting the tone for the entire tech ecosystem."

What Happens Next?

Regardless of the outcome, Nvidia's earnings will shape investor sentiment for months. A strong report could accelerate AI adoption, pushing stocks like Microsoft, Google, and Meta higher. Conversely, disappointing results might prompt a reevaluation of AI valuations, potentially cooling the speculative fervor around "AI everything."

For now, the world waits. Nvidia's chips may power the AI revolution, but today, its earnings report will determine whether that revolution continues its explosive march or faces a critical juncture. Buckle up—this is one earnings call you won't want to miss.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.