Nvidia Stock Soars on AI Chip Boom

Nvidia Stock: Riding the AI Revolution to Record Heights

In the fast-evolving landscape of artificial intelligence, one company stands out as both architect and beneficiary of the ongoing technological revolution. Nvidia (NVDA) has emerged as the undisputed leader in AI chip manufacturing, driving unprecedented growth in its stock price as demand for its cutting-edge processors continues to surge.

The semiconductor giant's stock performance has mirrored the explosive growth of generative AI applications, with its market capitalization soaring by over 150% in the past year. This remarkable trajectory reflects Wall Street's recognition that Nvidia has positioned itself at the heart of the AI transformation, supplying the critical computational power that fuels everything from large language models to autonomous vehicles.

The Engine Behind the AI Explosion

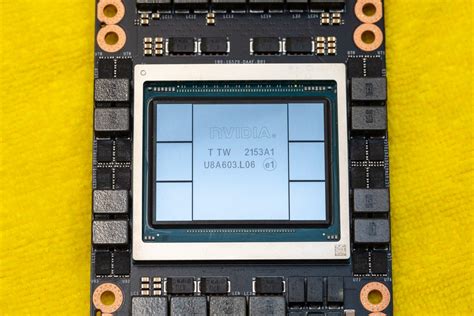

At the core of Nvidia's dominance lies its flagship data center GPU, the H100. This powerhouse processor has become the industry standard for training and deploying cutting-edge AI models. Unlike traditional graphics cards, the H100 is specifically optimized for the massive parallel processing requirements of modern AI workloads, featuring specialized Tensor Cores and fourth-generation NVLink interconnect technology.

"The demand for our AI chips has exceeded even our most optimistic projections," Jensen Huang, Nvidia's CEO, stated during a recent earnings call. "We're fundamentally expanding the data center market as enterprises race to integrate AI into their operations."

Financial Milestones and Market Validation

Nvidia's financial results tell a compelling story of market validation. The company recently reported a 101% year-over-year increase in data center revenue, with quarterly earnings exceeding $10 billion for the first time in history. This performance has prompted analysts across Wall Street to revise their price targets upward, with some projecting the stock could reach $600 within the next 12 months.

"Nvidia has created a powerful ecosystem that extends beyond hardware. Their CUDA platform and software libraries create switching costs that competitors will struggle to overcome," observed a leading technology analyst at a major investment bank.

Competitive Landscape and Future Growth

Despite Nvidia's commanding lead, competition is intensifying. Companies like AMD and Intel are aggressively developing their own AI accelerators, while cloud providers such as Amazon and Google are designing custom chips. However, Nvidia's head start in developing a comprehensive software ecosystem gives it a significant advantage.

Looking ahead, several key factors will determine Nvidia's continued success:

- Expansion into emerging markets like quantum computing and edge AI

- Growth in automotive applications with DRIVE platform adoption

- Increasing AI spend from healthcare and financial services sectors

Risks and Considerations

Investors should remain mindful of potential headwinds. The cyclical nature of the semiconductor industry, potential regulatory scrutiny, and the threat of technological disruption pose risks to Nvidia's meteoric rise. Additionally, any slowdown in enterprise AI adoption could significantly impact future growth projections.

The Road Ahead

As AI becomes increasingly integrated into every aspect of business and daily life, Nvidia's position as the primary hardware provider appears secure. The company's relentless innovation cycle, exemplified by the upcoming Blackwell architecture, suggests it will continue to set the pace for the industry.

For investors seeking exposure to the AI revolution, Nvidia represents both the current market leader and a critical enabler of the technology that will define the next decade. While the stock has already experienced substantial gains, many analysts believe the long-term growth story is just beginning to unfold.

Share this article

Sarah Johnson

Technology journalist with over 10 years of experience covering AI, quantum computing, and emerging tech. Former editor at TechCrunch.