Palantir Stock: AI Growth Story Accelerates After Nvidia's Strong Earnings

Introduction

Palantir Technologies (PLTR) has emerged as one of the most compelling players in the artificial intelligence revolution, with its stock becoming a multibagger that has surged over 2,000% since the launch of its Artificial Intelligence Platform (AIP) in April 2023. However, recent market volatility has sparked questions about whether the AI boom is sustainable or if we're witnessing an AI bubble. Recent earnings from Nvidia (NVDA) may have provided the answer.

Palantir's Impressive Q3 Performance

Palantir's third-quarter fiscal 2025 results were nothing short of spectacular, with revenue surging 63% year-over-year to $1.18 billion. This performance was driven by exceptional growth across key segments, particularly in the U.S. commercial sector, which saw revenue skyrocket by 121% year-over-year. The company's adjusted earnings per share also grew by 110% to $0.21, demonstrating improving profitability alongside its top-line growth.

Even more telling is Palantir's total contract value, which reached a record $2.8 billion—an increase of 151% year-over-year. This metric serves as a leading indicator of future revenue, as it represents the total value of contracts that are yet to be fully recognized on the income statement. The company's remaining performance obligation (RPO) also grew by 65% to $2.6 billion, further solidifying the foundation for continued growth.

The AI Bubble Debate

Despite these impressive fundamentals, Palantir's stock has faced pressure from growing concerns about an AI bubble. Critics, including notable figures like Michael Burry of "The Big Short" fame, have warned that valuations in the AI space may be unsustainable. These concerns have created a volatile trading environment for AI-related stocks, including Palantir.

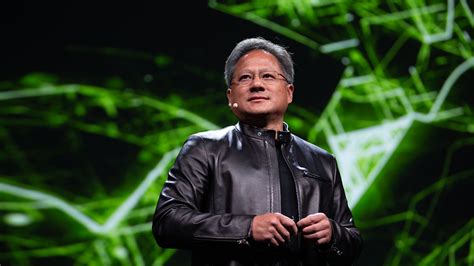

"There's been a lot of talk about an AI bubble. From our vantage point, we see something very different." - Jensen Huang, CEO of Nvidia

However, recent earnings from Nvidia may have provided the definitive answer to this debate. The chipmaker reported record quarterly revenue of $57 billion, up 62% year-over-year, with its data center segment—responsible for AI computing—delivering $51.2 billion in revenue, up 66% year-over-year. These results suggest that not only is AI adoption continuing at a brisk pace, but it may be accelerating.

Nvidia's Validation of the AI Revolution

Nvidia's CEO Jensen Huang left no doubt about the strength of the AI market during his company's earnings call. He highlighted that sales of the company's AI-centric Blackwell chips were "off the charts" and that their graphics processing units (GPUs) were "sold out." More importantly, Huang outlined three massive platform shifts he believes are fueling unprecedented infrastructure investments:

- Transition from CPU- to GPU-accelerated computing

- Advent of generative AI transforming existing applications

- Development of agentic and physical AI systems

Huang's perspective directly counters the narrative of an AI bubble, suggesting instead that we're in the early stages of a multi-year transformation. This validation from the company at the heart of the AI hardware revolution provides strong support for Palantir's growth thesis.

Palantir's Strategic Position in Enterprise AI

While Nvidia has established itself as the leader in AI hardware, Palantir has similarly positioned itself as the leader in enterprise AI software. The company's AIP has become the gold standard for helping businesses and governments make data-driven decisions by connecting systems that contain siloed data, aggregating information in one place, and conducting fundamental analysis.

What makes Palantir's offering particularly compelling is its ability to integrate deeply with existing business systems, enabling executives to make real-time decisions that save time and money. This capability has driven record demand for AIP, with Palantir's U.S. commercial customer count jumping 65% in the third quarter.

Future Outlook: The Beginning of Something Bigger

As impressive as Palantir's recent results are, they may only represent the beginning of what's possible. Jensen Huang himself called Palantir's Ontology "probably the single most important enterprise stack in the world," highlighting the strategic importance of Palantir's technology in the broader AI ecosystem.

The company's partnership with Nvidia further strengthens its position, creating a powerful combination of AI hardware and software capabilities. As enterprises continue to invest heavily in AI infrastructure, Palantir is well-positioned to benefit from this trend by providing the software layer that turns raw computing power into actionable insights.

With a growing pipeline of enterprise customers, expanding margins, and a clear addressable market that is still in its early stages, Palantir appears to be building a sustainable competitive advantage in one of the most important technological shifts of our time. While short-term volatility may continue as market sentiment evolves, the long-term growth story for Palantir remains compelling.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.