QQQ Stock: Recent Drops and What Investors Should Know

The Invesco QQQ Trust (QQQ), tracking the Nasdaq-100 Index, has recently caught investors' attention with notable price movements and strategic developments. As one of the most popular ETFs for tech-focused growth, QQQ's recent volatility offers valuable insights for market participants.

Recent Price Movements

QQQ has experienced significant intraday volatility in early November 2025. On November 4, the ETF's stock price fell by 2%, dropping from a previous close of $632.08 to $619.25. Trading volume surged to over 62 million shares—31% above the daily average—as investors reacted to broader market shifts.

Just two days later on November 6, QQQ declined further by 1.9% intraday to $611.67, pulling back from a $623.28 close. This session saw even heavier trading volume of approximately 70.9 million shares—about 50% above average—indicating heightened market activity. The stock's 50-day moving average currently stands at $599.86, while its 200-day moving average is at $557.61, suggesting the ETF remains in an overall uptrend despite recent dips.

Dividend Increase Amid Volatility

While facing short-term price pressure, QQQ recently increased its quarterly dividend from $0.59 to $0.694, representing an annualized dividend of $2.78 with a yield of approximately 0.5%. This payout was distributed on October 31, 2025, to shareholders of record as of September 22. The dividend hike signals the fund's commitment to returning capital to investors even during turbulent periods.

"The increased dividend comes despite market volatility, reflecting the underlying strength of the Nasdaq-100's constituent companies."

Strong Institutional Interest

Institutional investors have demonstrated significant confidence in QQQ through recent stake increases. Several major firms have expanded their holdings:

- Banco Santander S.A. more than doubled its position, increasing holdings by 100.2% during the first quarter.

- Principal Financial Group raised its stake by 62.6% in Q1.

- Brighton Jones LLC boosted its holdings by 15.0% in Q4.

- Amundi grew its position by 6.3% in Q1.

These moves are part of a broader trend where institutions now own approximately 44.6% of QQQ shares, reinforcing the ETF's status as a cornerstone in institutional portfolios.

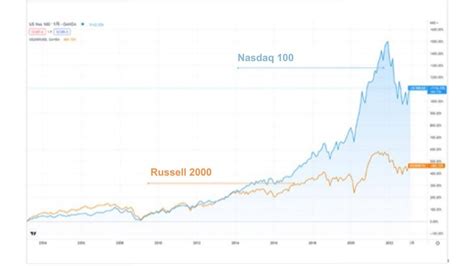

Understanding QQQ's Position

As a unit investment trust tracking the Nasdaq-100 Index, QQQ provides exposure to the largest non-financial companies listed on the Nasdaq. The fund holds substantially all index components in their respective weightings, making it a direct play on the technology sector's performance. Its composition includes powerhouse stocks like Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), and NVIDIA (NVDA), which collectively influence the ETF's movements.

What's Next for Investors?

While recent declines may raise concerns, QQQ's fundamentals remain robust. The dividend increase and continued institutional buying suggest long-term confidence in the underlying index. Investors should consider:

- Technical Levels: Monitor the 50-day moving average ($599.86) for support and resistance.

- Market Sentiment: Watch volatility indicators like VIX and sector rotation patterns.

- Fundamental Shifts: Track quarterly earnings reports from key Nasdaq-100 constituents.

For diversified portfolios, QQQ continues to offer exposure to innovation-driven growth, though investors should balance it with more stable assets to manage sector concentration risk.

Share this article

Dr. David Chen

Science correspondent with a Ph.D. in astrophysics, passionate about making complex scientific discoveries accessible to all.