September Jobs Report: Unemployment Rises to 4.4%

The Labor Market's Mixed Signals After a Data Drought

The U.S. labor market delivered a mixed bag in September, with employers adding more jobs than expected but facing revised downward figures for previous months and a rising unemployment rate. This delayed report, released after a 44-day government shutdown, comes as the Federal Reserve prepares for its December meeting and voters assess the economy's trajectory.

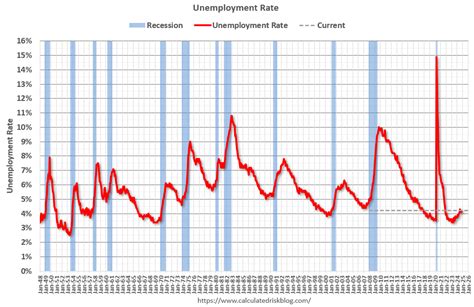

The Bureau of Labor Statistics (BLS) reported that nonfarm payrolls increased by 119,000 jobs in September, significantly beating economists' expectations of 50,000. However, the unemployment rate edged up to 4.4%—the highest since October 2021. A broader measure of unemployment (U-6) that includes discouraged workers and those employed part-time for economic reasons actually decreased slightly to 8%.

Wage growth showed modest signs of cooling, with average hourly earnings rising 0.2% for the month and 3.8% year-over-year, slightly below forecasts of 0.3% and 3.7% respectively.

Revisions Uncover Labor Market Weakness

September's gains came with significant revisions. August's initially reported 22,000 job gains were revised to a loss of 4,000, while July's figures were lowered by 7,000. These downward adjustments mean that 33,000 previously reported jobs from the Trump era have now been erased from the record.

'These numbers are a snapshot from two months ago and they don't reflect where we stand now in November.' — Daniel Zhao, Chief Economist at Glassdoor

Government employment has been particularly hard hit, with federal jobs declining by 97,000 since January's peak. The BLS clarified that workers on paid leave or severance remain classified as employed in its establishment survey, masking some of the true labor market contraction.

Shutdown and Political Turmoil Cloud the Picture

The report's release was delayed by the nation's longest government shutdown, which prevented the BLS from collecting data. This disruption has forced the agency to release October and November figures simultaneously on December 16, with October's report lacking the standard unemployment rate calculation.

Political tensions further complicated the report's release. President Trump fired BLS Commissioner Erika McEntarfer in August after the agency released massive downward revisions for prior months. Trump accused the BLS of rigging numbers to make him look bad, tweeting: “In my opinion, today's Jobs Numbers were RIGGED.”

Market and Fed Reactions

Despite the mixed signals, stock markets reacted positively to the stronger-than-expected September job gains, seeing them as evidence of economic resilience. Bond markets, however, were encouraged by the unemployment uptick and wage cooldown, which may keep the door open for a December Fed rate cut.

“Equities like the fact that payrolls were stronger than expected, suggesting the economy is still on a firm footing, while the bond market likes the rise in unemployment and slowdown in wage growth,” noted Seema Shah, Chief Global Strategist at Principal Asset Management.

The Federal Reserve faces a tough decision in December. With this being the last jobs report before their meeting, policymakers will have to weigh conflicting signals: strong hiring versus rising unemployment and cooling wages.

Voter Sentiment Shifts Amid Economic Doubts

Public perception of the economy has soured. A Fox News national survey found 76% of voters rate the economy negatively, up from 67% in July. Voters increasingly blame President Trump for the downturn, with twice as many holding him responsible compared to former President Biden.

Trump has centered his second term around economic promises of tax cuts, deregulation, and energy expansion. However, his approval ratings on economic handling have dropped to new lows, even among some core supporters.

What's Next for the Labor Market?

As the BLS works to catch up on delayed data, the December 16 release of October and November figures will provide a clearer picture of the labor market's direction. For now, the September report suggests a labor market still resilient but showing clear signs of softening, with employers reluctant to make dramatic hiring or firing decisions amid economic uncertainty.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.