S&P 500 Slips Below Key Level: What's Next?

Market Turbulence Signals Potential Shift

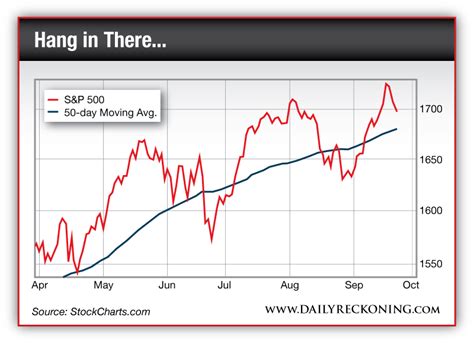

Wall Street is watching closely as the S&P 500 (SP500) recently slipped below its critical 50-day moving average, closing at 6,672.40 after a three-day losing streak – the first such downturn in nearly two months. This breach of a key technical indicator has investors reevaluating market sentiment amid rising uncertainty.

Understanding the Technical Significance

The 50-day moving average serves as a crucial psychological and technical benchmark for many institutional investors. Its breach often signals potential weakness, though historical data suggests such dips may present buying opportunities. According to market analysts, the S&P 500 has previously rebounded quickly after similar events, with average gains of +3.7% and +1.5% occurring within a month following comparable technical breaks.

Key Factors Driving the Downturn

Several converging pressures have contributed to this recent market slide:

- AI Sector Weakness: Artificial intelligence stocks have experienced significant volatility, dragging tech-heavy indices lower

- Hawkish Fed Tone: Recent Federal Reserve remarks suggest tighter monetary policy may persist longer than anticipated

- Data Vacuum: The ongoing U.S. government shutdown has limited the release of key economic indicators, creating market uncertainty

Futures Market Reaction

The stock market futures market is responding sharply to these developments. Dow Jones futures and djia futures are showing notable pre-market volatility, with traders positioning for potential further declines. Stock market futures across major indices indicate cautious sentiment, as investors monitor now for follow-through selling pressure.

Historical Context Offers Cautious Optimism

While the current breach raises concerns, history suggests resilience. The S&P 500 has demonstrated a tendency to stabilize quickly after technical breaks, typically experiencing only minor drawdowns before resuming its upward trajectory.

What Investors Should Watch Now

Market participants should focus on several critical indicators:

- Whether the S&P 500 can reclaim the 50-day moving average in coming sessions

- Reaction in stock market futures during key economic data releases

- Performance of AI stocks as a sector bellwether

- Any signals from Federal Reserve officials regarding future interest rate decisions

Strategic Considerations

For long-term investors, this technical breach may present opportunities to accumulate quality stocks at more attractive valuations. However, short-term traders should exercise caution, as dow futures now indicate heightened volatility. The overall futures market sentiment will likely remain sensitive to any new developments regarding the fiscal situation or monetary policy.

The Path Forward

As the market digests these developments, the coming week will be pivotal. The S&P 500's ability to hold above key support levels and the direction of dow jones futures will provide crucial signals about whether this is a temporary correction or the beginning of a more significant trend change.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.