S&P 500 Tumbles as AI, Rate Worries Mount

Market Reversal: What Caused the S&P 500's Recent Decline?

What began as a promising trading session quickly turned into a significant market rout as investors grappled with mounting concerns about artificial profitability and Federal Reserve policy. The S&P 500 index dropped more than 1.5%, while the tech-heavy Nasdaq fell 2%, reflecting broad-based uncertainty across the market.

The dramatic reversal came after an early surge that saw the Dow Jones Industrial Average climb 700 points before ultimately falling nearly 390 points by the end of the day. This volatility wasn't limited to traditional stocks—cryptocurrencies also took a hit, with Bitcoin falling below $87,000 after previously reaching highs above $120,000.

Key Drivers Behind the Market Sell-Off

Several interconnected factors contributed to Thursday's market downturn, creating a perfect storm of investor anxiety:

"You don't have to have the biggest bubble in history for an expensive stock market and end up seeing declines."

— Matt Maley, chief market strategist at Miller Tabak asset management group

Fed Policy Expectations Shift

The September jobs report, showing 119,000 new jobs with unemployment ticking up to 4.4%, initially boosted market optimism. However, the strong employment figures led analysts to conclude that the Federal Reserve is less likely to cut interest rates next month. When interest rates remain high, borrowing costs increase, potentially slowing economic activity and reducing corporate profits.

"The broad rebound in payrolls suggests diminished risks of a higher unemployment rate," analysts with Morgan Stanley noted. "We no longer expect a Fed cut in December."

AI Profitability Concerns

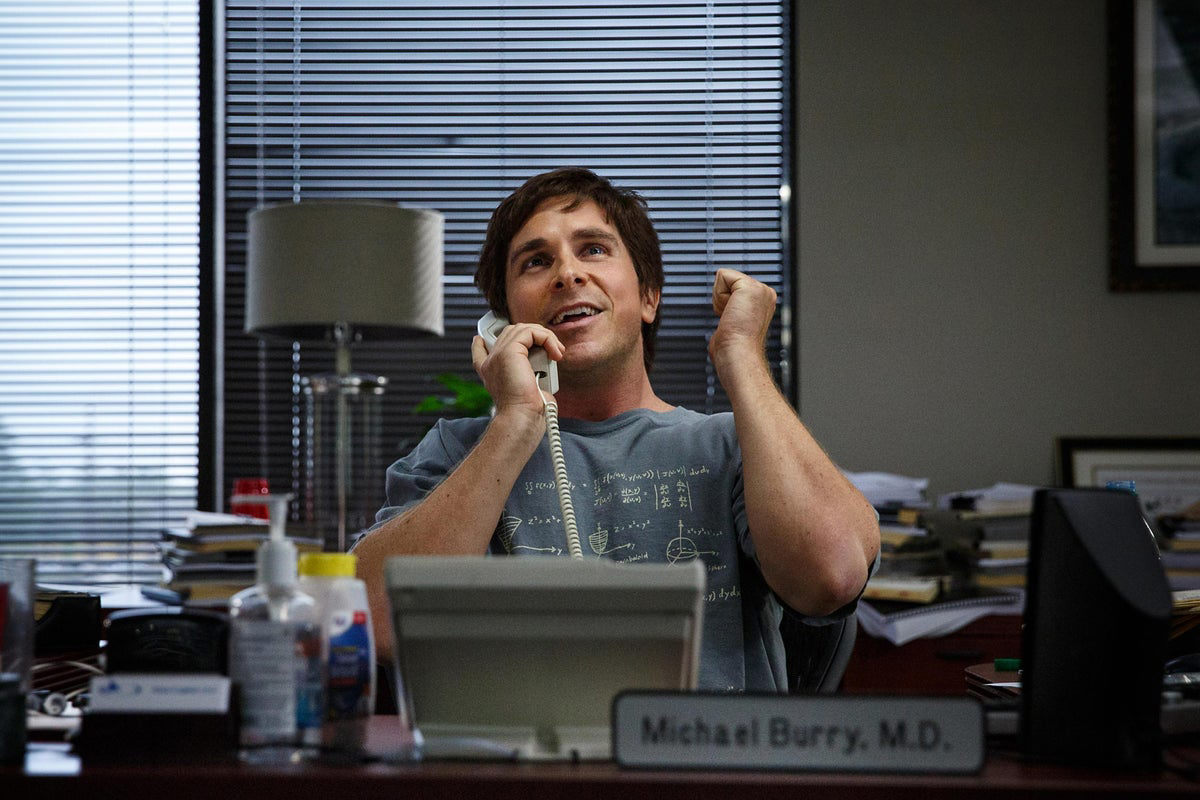

Despite strong quarterly earnings from Nvidia—a key player in the artificial intelligence boom—investors grew skeptical about the long-term profitability of AI investments. This concern was amplified by comments from "Big Short" investor Michael Burry, who warned: "Just because something is used does not mean it is profitable."

Consumer Spending Under Pressure

The market downturn coincides with growing evidence that consumer spending, a critical driver of the economy, is showing signs of strain. Walmart's recent earnings report revealed that while the retail giant is attracting more high-income bargain shoppers, lower-income families are feeling increased financial pressure.

"As pocketbooks have been stretched, you're seeing more consumer dollars go to necessities versus discretionary items," said Walmart CFO John David Rainey. This shift suggests that economic resilience may be uneven across different income levels.

Layoff Announcements Add to Economic Uncertainty

The market's downward trajectory was further complicated by a wave of layoff announcements from major corporations. Verizon recently revealed plans to cut 13,000 jobs, joining other blue-chip employers including Amazon, General Motors, IBM, Microsoft, Paramount, Target, and UPS in workforce reductions.

These job cuts come despite the positive headline jobs numbers, suggesting a more complex labor market picture than the statistics alone might indicate. The manufacturing sector shed 6,000 jobs in September, while transportation and warehousing lost 25,300 positions.

What Comes Next for Investors?

Market experts offer mixed perspectives on the current situation, with many characterizing it as a transition rather than a definitive shift in market direction.

"I wouldn't say we've flipped from bull to bear," said Steve Sosnick, chief strategy officer at Interactive Brokers. "I would say we've flipped from bull to balanced market in the short term. A lot depends on whether sentiment continues to weaken."

With the S&P 500 falling to its lowest point since September, investors will be closely watching upcoming economic data, Federal Reserve communications, and corporate earnings reports for signals about the market's next direction.

While Thursday's decline was significant, it may represent more of a healthy correction in an overvalued market rather than the beginning of a prolonged bear market. The key question for investors is whether the underlying economic fundamentals remain strong enough to support continued growth—or if we're seeing the first signs of a more substantial downturn.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.