Why Is the Stock Market Down Today?

Watching your portfolio in the red can be nerve-wracking, especially when there's no obvious headline news. Stock market declines happen daily, but sudden drops often leave investors scrambling for answers. If you're wondering what's driving today's market downturn, you're not alone. Let's break down the most common culprits behind market volatility and what they mean for your investments.

Economic Headwinds: Data Disappoints

Markets react strongly to economic indicators that signal the health of the economy. Often, today's dip stems from fresh data revealing:

- Inflation surprises: Higher-than-expected inflation numbers (like CPI or PPI reports) trigger fears of aggressive interest rate hikes by central banks.

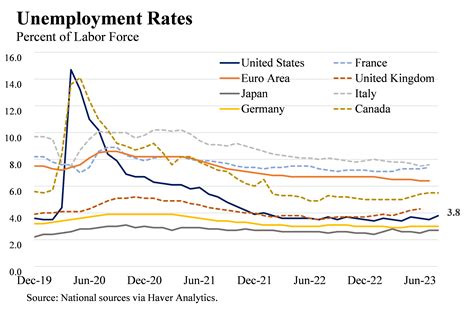

- Labor market shifts: Unemployment rate spikes or job growth slowdowns signal potential recession risks.

- Manufacturing weakness - Declining PMI (Purchasing Managers' Index) readings indicate economic contraction.

When these metrics miss forecasts, investors recalibrate growth expectations, often triggering sell-offs.

Central Bank Policy Moves

Federal Reserve actions are market-moving events. Even subtle shifts in tone or policy guidance can spark volatility:

- Rate hike signals: Unexpectedly hawkish language from Fed officials implies tighter monetary policy ahead.

- Balance sheet reduction: Accelerating quantitative tightening (QT) reduces market liquidity.

- Forward guidance changes: Revised interest rate projections alter investor discount rates for future cash flows.

Markets price in anticipated Fed moves, so any deviation from consensus expectations can trigger immediate reactions. Today's decline might reflect yesterday's Fed speech or upcoming meeting minutes.

Geopolitical Jitters and Global Risks

Global events create uncertainty that spook investors:

- Trade tensions: Tariff announcements or diplomatic disputes disrupt supply chains.

- Regional conflicts: Escalations in Eastern Europe or the Middle East spark risk-off sentiment.

- Energy crises: Oil price spikes or supply disruptions raise inflation fears.

These events don't always make front-page news but create ripple effects through commodity prices and corporate earnings projections.

Corporate Earnings Warnings

Earnings season is a major volatility driver. A few red flags can drag down entire sectors:

- Pre-announcements: Companies issuing negative guidance before official reports.

- Revenue misses: Actual results falling short of analyst consensus expectations.

- Margin compression: Rising costs eating into profit margins despite strong sales.

When bellwether companies (like tech or industrials) report disappointing results, market sentiment sours quickly, even if your specific holdings aren't directly impacted.

Technical Factors and Market Sentiment

Sometimes, psychology drives markets:

- Algorithmic trading: Automated sell orders triggered at technical levels (like moving averages).

- Options expirations - Unusual activity in index options can amplify volatility.

- Profit-taking: Investors locking in gains after recent rallies.

Technical indicators like the VIX (fear index) often spike during these periods, reflecting heightened investor anxiety.

"Markets stay irrational longer than you stay solvent" - John Maynard Keynes remains relevant in volatile sessions like today's.

What Should Investors Do?

While market dips are unsettling, remember:

- Check your allocation: Ensure your portfolio aligns with your risk tolerance and long-term goals.

- Focus on fundamentals: Quality companies with strong balance sheets often recover faster.

- Avoid panic selling: History shows that time in the market beats timing the market.

Use these moments to review your strategy, not abandon it. If you're unsure, consult a financial advisor before making major moves.

Looking Ahead

Market corrections are normal. Today's downturn could reverse quickly with positive data or calming rhetoric. Stay informed by monitoring:

- Upcoming CPI and retail sales reports

- Federal Reserve meeting minutes

- Quarterly earnings from key indices

- Geopolitical developments

Remember that volatility creates opportunities for disciplined investors. Keep a long-term perspective and use these dips as potential entry points for quality assets.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.