The Worst Retirement Age? Avoid These Social Security Mistakes

Retirement planning is complex, but one decision stands out as potentially disastrous: claiming Social Security benefits at age 62. Financial experts consistently identify this as the least optimal age for most retirees, yet nearly one in four Americans still make this choice. Let's explore why 62 is considered the retirement age to avoid and how strategic timing could significantly impact your financial future.

Why Age 62 is the Financial Trap

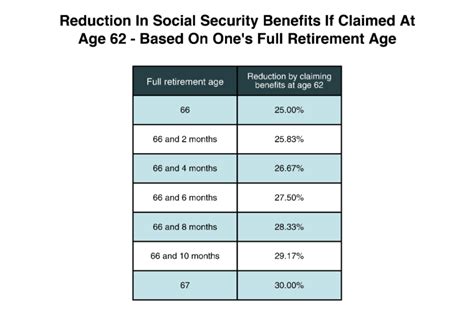

For those born in 1960 or later, full retirement age (FRA) is 67. Claiming benefits at 62 triggers a permanent reduction of 30% compared to your FRA amount. This isn't minor—it's equivalent to losing nearly one-third of your potential lifetime income.

A 2019 United Income study found 92% of people would be better off waiting until at least age 65 to claim Social Security. Only 6.5% saw greater wealth by claiming before 64. #RetirementPlanning #SocialSecurity

— Financial Planning Institute (@FinPlanInstitute) November 17, 2025

The math is brutal: for each month before FRA, benefits are reduced by 5/9 of 1% for the first 36 months, then 5/12 of 1% beyond that. This compounds over decades, creating a wealth gap that's hard to recover from.

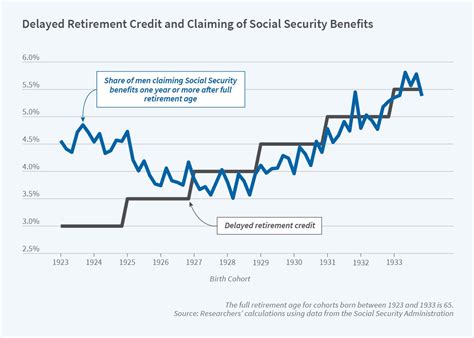

The Power of Delaying Benefits

While claiming early penalizes you, waiting beyond your FRA exponentially rewards you. For each year you delay benefits between 67 and 70, you earn 8% in delayed retirement credits. By 70, your benefits can increase by up to 24% compared to FRA.

Research from the Federal Reserve Bank of Atlanta and Boston University confirms this: over 90% of workers aged 45-62 would be financially better off waiting until age 70 to claim benefits. The data shows that for most retirees, this patience pays off significantly over time.

When Early Claiming Might Make Sense

While 62 is statistically the worst age, exceptions exist. If you have a shorter life expectancy or face urgent financial needs due to job loss, claiming early might be necessary. Similarly, if you're in poor health or have a family history of shorter lifespans, the calculus changes.

However, even if you claim at 62 while working, beware of the earnings test. Social Security will "claw back" $1 for every $2 earned above certain thresholds ($22,320 in 2025). While you get this money back later, the cash flow disruption can be problematic.

Beyond the Numbers: Holistic Retirement Planning

Financial optimization isn't the only factor. Consider your health, career satisfaction, and retirement goals. Some people trade reduced Social Security for earlier freedom from work—a valid personal choice if you understand the trade-offs.

Remember, retirement isn't just about a single number. It's about crafting a sustainable lifestyle. While 62 might be statistically suboptimal, what matters most is aligning your claiming strategy with your unique circumstances and long-term vision.

The Bottom Line

Age 62 is the statistically worst retirement age for claiming Social Security due to permanent benefit reductions. For most retirees, waiting until 70 maximizes lifetime income. But always consult a financial advisor to evaluate your personal situation—the perfect retirement age is one that balances financial wisdom with life's realities.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.