Alphabet (GOOGL) Stock: Bullish Bets Amid Mixed Signals

Introduction

Alphabet Inc. (NASDAQ: GOOGL) continues to dominate headlines as institutional investors reposition their holdings, analysts raise price targets, and the tech giant unveils its first dividend. Recent regulatory filings reveal a complex landscape of confidence and caution surrounding Google's parent company, offering critical insights for investors navigating this $3.4 trillion behemoth.

Institutional Investors: Confidence Through Mixed Signals

Recent SEC filings paint a nuanced picture of institutional sentiment toward GOOGL. Notably, Horizon Investment Services LLC trimmed its stake by 2.6% to 47,239 shares (worth $8.33 million), though the position remains its 5th largest holding at 3.6% of the portfolio. This contrasts with TD Waterhouse Canada Inc., which boosted its position by 2.3% to 760,417 shares (valued at $134.5 million), making Alphabet its 25th-largest holding. Meanwhile, Cambiar Investors LLC increased its stake to 337,064 shares ($59.4 million), representing 2.5% of its portfolio as a top-5 holding.

These moves reflect broader institutional activity, with firms like Bridgeway Capital Management and Mystic Asset Management also expanding their positions. Hedge funds and institutional investors collectively own 40.03% of Alphabet's shares, undersoring continued institutional confidence despite nuanced adjustments.

Strong Earnings and Historic Dividend Announcement

Alphabet's financial performance remains a cornerstone of bullish sentiment. In its latest quarter, the company delivered EPS of $2.87, significantly surpassing analysts' estimates of $2.29. Revenue reached $102.35 billion, exceeding expectations of $99.90 billion and marking a 15.9% year-over-year increase. This performance, coupled with a robust net margin of 32.23% and return on equity of 36.08%, demonstrates the company's operational efficiency.

Equally significant is Alphabet's inaugural dividend declaration: a quarterly payment of $0.21 per share (annualized $0.84, yielding 0.3%), payable December 15 to shareholders of record by December 8. This move signals a strategic shift toward returning capital to shareholders, though the payout ratio remains conservative at 8.28%.

Analysts Raise Targets Amid "Moderate Buy" Consensus

Wall Street's optimism is crystallizing in rising price targets. Daiwa Capital Markets lifted its target to $333, while JPMorgan Chase & Co. increased its outlook to $300. Canaccord Genuity and Pivotal Research now see $330 and $350 respectively, with Deutsche Bank setting an ambitious $340 target. The analyst consensus rests on a "Moderate Buy" rating, with an average price target of $304.10-$324.81 across GOOGL and GOOG shares.

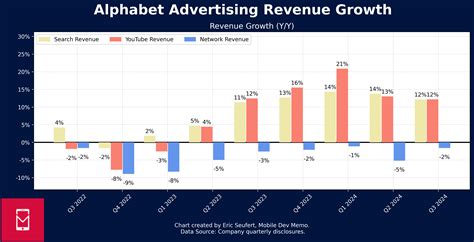

This bullish sentiment stems from Alphabet's dominance in AI, cloud computing, and digital advertising. The company's 200-day moving average of $211 reflects sustained upward momentum, despite recent insider selling.

Insider Trading: Selling Amid Growth

Despite institutional and analyst enthusiasm, insider transactions reveal caution. CEO Sundar Pichai sold 32,500 shares in October, reducing his holdings by 1.35% to 2.36 million shares. Chief Accounting Officer Amie Thuener O'toole similarly sold 2,778 shares. Collectively, insiders have sold 189,896 shares worth $47.7 million over the last quarter, though they still maintain significant ownership at 11.55%.

While insider selling often signals concerns, it may reflect portfolio diversification rather than fundamental concerns, especially given Alphabet's soaring stock price (up 5.77% recently) and restricted stock units.

What's Next for Alphabet?

Alphabet stands at a pivotal juncture: balancing growth investments in AI and cloud with shareholder returns. The dividend marks a new era, but investors should monitor AI monetization, regulatory challenges, and competition from Microsoft and Meta. With analysts projecting EPS of $8.90 for the fiscal year and institutional ownership remaining robust, GOOGL appears positioned for continued volatility fueled by innovation.

For investors, the key lies in discerning between short-term noise and long-term fundamentals. Alphabet's core businesses remain cash-generative, while its "Other Bets" segment holds transformative potential. As the company navigates its next growth phase, Alphabet's stock may reward patient investors amid market fluctuations.

Share this article

Sarah Johnson

Technology journalist with over 10 years of experience covering AI, quantum computing, and emerging tech. Former editor at TechCrunch.