AVGO Stock: AI Powerhouse Poised for Growth

Broadcom Inc. (NASDAQ: AVGO) has emerged as a quiet giant in the artificial intelligence revolution, with its stock climbing over 55% in 2025. While Nvidia often dominates AI chip headlines, AVGO is quietly building an empire in custom silicon solutions that could fundamentally reshape the AI landscape.

The Custom Silicon Advantage

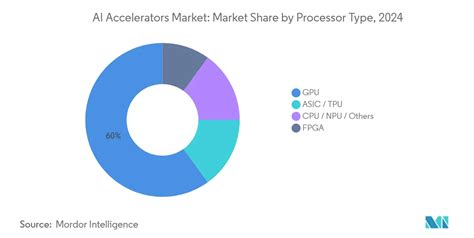

Unlike general-purpose GPUs from competitors, Broadcom specializes in application-specific integrated circuits (ASICs) – chips designed for hyperscalers' unique AI workloads. This focus has yielded an estimated 75% market share in custom AI accelerators, making Broadcom the go-to partner for tech giants building next-generation infrastructure.

Recent partnerships underscore this dominance:

- OpenAI Deal: Collaboration deploying 10 gigawatts of custom AI accelerators

- Meta Platforms: Custom chip development for social media AI

- Alphabet: Key role in Google's tensor processing unit (TPU) hardware

- $10B New Contract: Mysterious hyperscaler deal likely with Anthropic

Massive AI Infrastructure Tailwinds

Broadcom's timing couldn't be better. Goldman Sachs projects hyperscalers like Alphabet, Microsoft, Amazon, and Meta will spend nearly $500 billion on AI capex next year alone. More bullish forecasts from McKinsey estimate the total AI infrastructure market could hit $7 trillion by 2035 – a projection aligning with Nvidia CEO Jensen Huang's "multitrillion-dollar" thesis.

"Against this backdrop, Broadcom's existing hyperscaler deals are small relative to the expected size of the overall AI infrastructure opportunity." – Motley Fool Analysis

Earnings Catalysts and Growth Trajectory

With fiscal Q4 2025 earnings due mid-December, Broadcom is poised to beat consensus expectations. Analysts anticipate accelerating growth from three key areas:

- AI Accelerator Sales: Custom ASIC orders from hyperscalers

- Software Revenue: Infrastructure software growth

- Non-AI Semiconductor Recovery: Broader market stabilization

Historical performance shows a clear pattern: Broadcom has gained over 9% in a single day after beating earnings estimates, reflecting investor confidence in its execution.

Valuation Considerations

Despite impressive growth, AVGO trades at 38x forward earnings. While this limits near-term upside to approximately 7% according to Seeking Alpha analysts, long-term investors should consider:

- Expanding hyperscaler relationships

- Increasing complexity of AI workloads demanding custom solutions

- Software segment margins complementing hardware growth

As The Motley Fool notes, "Broadcom becomes a more compelling buy-and-hold opportunity for long-term investors" positioned to capture the multi-decade AI infrastructure buildout.

The Bottom Line

Broadcom's dominance in custom AI chips, combined with unprecedented hyperscaler spending, positions AVGO as a critical enabler of the AI revolution. While short-term valuation may temper enthusiasm, the company's strategic partnerships and 75% market share in custom accelerators suggest significant upside potential as AI infrastructure scales in the coming years.

For investors seeking exposure to AI beyond the GPU hype cycle, AVGO offers a compelling play on the foundational chips powering tomorrow's artificial intelligence systems.

Share this article

Sarah Johnson

Technology journalist with over 10 years of experience covering AI, quantum computing, and emerging tech. Former editor at TechCrunch.