MU Stock: Riding the AI Memory Boom

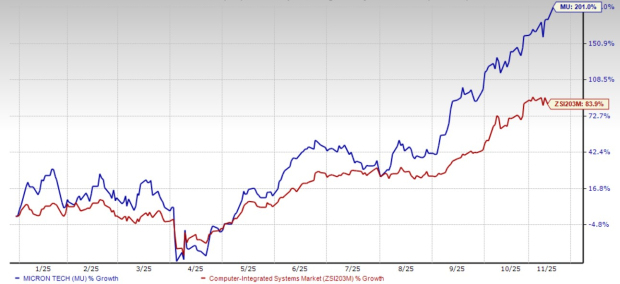

Micron Technology (MU) has become one of the most talked-about stocks in the tech sector, fueled by unprecedented demand for memory chips driven by artificial intelligence (AI) expansion. Investors who bought in a year ago have seen their investments more than double, but what’s driving this momentum and is it sustainable?

The AI-Fueled Memory Revolution

At the heart of Micron's surge is the explosive growth in AI infrastructure. Data centers are rapidly upgrading systems to handle AI workloads, creating a massive demand for high-performance memory chips. This has translated to a 46% year-over-year revenue increase in Micron's recent quarter, with selling prices for memory products climbing due to tight supply-demand dynamics.

Financial Performance: Record-Breaking Numbers

Micron's financial results reflect this unprecedented demand:

- Revenue Surge: 46% YoY growth driven by data center sales

- Earnings Explosion: Earnings per share (EPS) jumped 258% YoY

- Market Impact: A $1,000 investment one year ago would now be worth approximately $2,512

Analysts attribute this success to Micron's strategic positioning in AI-optimized memory solutions, particularly high-bandwidth memory (HBM) chips critical for AI training and inference.

Analyst Outlook: Continued Growth Ahead

Bullish analysts project sustained momentum through 2026 and beyond:

- Earnings Forecast: $16.79 per share in fiscal 2026 (ending August)

- Long-Term Projection: $18.70 EPS in the following fiscal year

- Price Target: Potential 14% upside to $280 based on a 15x forward P/E ratio

"Capital spending on AI in data centers is expected to exceed $400 billion by 2025, creating a tight demand/supply market for memory."

- Analyst Projection

The Flip Side: Market Disruptions

While Micron thrives, this memory boom presents challenges for other tech sectors. Companies reliant on memory chips face rising input costs, potentially squeezing profit margins for hardware manufacturers and AI solution providers. Market analysts caution that prolonged pricing strength could disrupt supply chains across the broader tech ecosystem.

Investment Considerations

For potential investors, several factors warrant attention:

- Volatility: The stock has experienced significant price swings

- Market Sentiment: Sensitive to economic conditions and tech spending cycles

- Long-Term Potential: AI infrastructure growth provides sustained tailwinds

"I wouldn't buy the stock expecting it to double again," cautions one analyst, "but this is a stock worth considering on dips, as the long-term outlook for growth in AI infrastructure provides significant growth opportunities for Micron."

Conclusion

Micron Technology stands at the epicenter of the AI revolution, benefiting from unprecedented demand for memory chips. While recent performance has been stellar, investors should weigh the volatility and broader market impacts. With analysts projecting continued growth through 2026, MU remains a compelling play on the AI infrastructure trend—though timing and risk management remain crucial.

Share this article

Sarah Johnson

Technology journalist with over 10 years of experience covering AI, quantum computing, and emerging tech. Former editor at TechCrunch.